Crypto is like a box of chocolates. You never know what you’re gonna get.

Gif by cbs on Giphy

There have been so many crazy things happening in this space in 2025 that our eyebrows have yet to return to their normal resting position. Corporations are buying up all the crypto…and all the crypto companies. And that’s not all that happened last week. Time to get after it.

From the Dypto Crypto Newsroom

Bitcoin Treasury Company Strive Acquires Semler Scientific

TLDR

Strive is a Bitcoin treasury company. So is Semler Scientific. This is the first time ever (to our knowledge) that one treasury company has bought another to acquire the company’s digital assets.

On top of that, Strive purchased more BTC for its own treasury.

The company was co-founded by former presidential candidate and self-made billionaire Vivek Ramaswamy.

Two Bitcoin treasury powerhouses just joined forces. Strive, Inc. announced its acquisition of Semler Scientific in an all-stock deal. Their plan for world domination? Creating what could become the fastest-growing corporate Bitcoin holder in the market.

Why the acquisition matters.

Both Strive and Semler Scientific have been doing the Bitcoin treasury thing for a while, betting that the token will be worth more in the future than dollars sitting in a bank account.

After this merger, the combined company will own over 10,900 Bitcoin. At current prices, that’s worth well over $1 billion. For context, that’s more Bitcoin than many small countries’ central banks hold.

The CFTC Has Launched a New Crypto Initiative

TLDR

The CFTC’s new initiative would allow institution-level investors to use stablecoins as collateral for derivatives trading.

That would require a lot of blockchain usage, increasing the speed and efficiency of trades, not to mention reduced fees — all savings that will (ideally) be passed on to customers/clients.

With so much tape around the current system in the US, it could breathe some fresh life into that TradFi market and introduce new people to DeFi derivatives.

The US Commodity Futures Trading Commission (CFTC), the big boss of derivatives markets, has recently launched a major initiative. They’re officially exploring the use of tokenized assets, particularly stablecoins, as collateral. So…what does that mean?

In short, imagine a world where people could use stablecoins as collateral instead of cash. It would be faster, cheaper, and run 24/7. There are two possibilities that jumped out to us. This is a game-changer for how money moves on the institutional level, and it’s a massive nod of approval for crypto from the US government.

Future Possibilities.

Perpetual exchanges, which are the DeFi equivalent of a derivatives platform, do nearly double the daily volume of regular decentralized exchanges. We’re talking over $50 billion a day in volume. TradFi wants a piece of that action. Currently, derivatives are heavily regulated, and many US users are limited in what they can do, which is why they’ve turned to DeFi in the first place.

We could, in the near future, see the TradFi version of these markets open up to everyone.

-OR-

We could also see more people educating themselves on the DeFi equivalents, giving decentralized perps exchanges a boost in volume. Either way, it’s good for crypto and crypto users.

It also paves the way for more innovation. The efficiencies gained in the derivatives market will likely trickle down, leading to new financial products and services that are faster and more accessible.

This Week in Corporate Crypto Treasury News

TLDR

MetaPlanet and Strategy filled up their BTC bags.

Bitmine now owns 2% of ETH, with a goal of getting to 5%.

BigAg company AgriFORCE is becoming an AVAX treasury company.

Last week was absolutely bonkers for crypto treasury companies. These massive companies continue to invest heavily in treasury strategies. Every week, there are significant acquisitions by the movers and shakers in institutional finance. Or at least, that’s how it seems lately.

The corporate world is waking up to what many of us have known for years: crypto isn’t internet money anymore. It’s becoming a legitimate treasury asset and has new use cases being born every day.

Should we expect this to continue?

Possibly. These corporate crypto treasury moves continue to accumulate. We’re watching the financial world’s architecture change in real-time.

When major corporations start dedicating hundreds of millions or billions of dollars to crypto assets, it shows the world that businesses approach storing value differently than they used to. These aren’t speculative plays — they’re strategic decisions by companies with serious financial expertise.

For crypto newcomers, this institutional adoption is huge validation. It suggests that crypto assets are moving from experimental internet money to legitimate financial instruments that major corporations trust with their treasuries.

Question of the Week

An X DM - “I’ve seen a lot of rug pulls happening lately. What’s going on?”

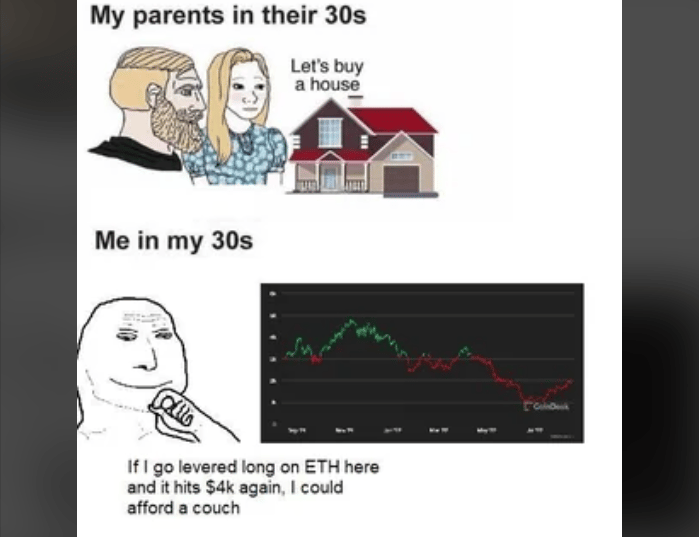

Meme of the Week

New Segment! - By the Numbers - The Dypto Crypto Portfolio

Here’s a screenshot of our portfolio, which we started in late December 2024. So…let’s just call it the first of the year.

The port is down a bit over the last week. We’re heavy into ETH right now, and the price slid a few hundred bucks over the last week. That’s ok. We established our protocols based on long-term, semi-passive strategies.

Next week, we’ll have a full monthly update about our overall September performance. Join our Circle community to see full updates from our Co-Founder and analyst, CJ Miller.

Deep Dive - x402 – What It Is and What It Means for Crypto Users

Remember those error codes you see online, like “404 Not Found”? There’s actually one called “402 Payment Required” that was created way back in the early days of the internet, but never really got used. It was like a dusty old tool nobody knew what to do with.

Coinbase and its partners decided to dust it off and give it a brand-new job. They’re using it to create a new standard for making instant payments directly over the web using stablecoins (like USDC).

Think of it like this: Instead of a website telling you “Hey, you need to pay,” x402 lets it say, “Hey, you need to pay, and here’s exactly how you can do it right now with crypto, automatically.”

This enables websites, apps, and even AI to send and receive small amounts of money instantly and frictionlessly. No more clunky subscription models or annoying paywalls — just simple, direct payments built into the fabric of the internet.

The coolest part about x402 isn’t that it’s a Coinbase thing. It’s that Coinbase doesn’t want it to be just a Coinbase thing. They’ve partnered with major players like Cloudflare. And that was the big news this week.

Coinbase and Cloudflare have created the x402 Foundation to help push the idea into the real world, getting more users to use and to get more devs working on it.

The goal is to make x402 an open, neutral standard that anyone can build on — like how HTTPS became the standard for secure websites. By creating a foundation, no single company controls it — encouraging widespread adoption and innovation from developers all over the world.

Question of the Week Answer

Yep. We’re seeing them too. This is one of the biggest problems in DeFi. New projects launch with a lot of empty promises to users looking for the next 100x moonshot. It rarely works out.

How do you protect yourself?

It’s hard. DeFi teams are usually anonymous. Or pseudonomous at the very least. Chats, from Discord to X, will be full of hype men looking to get in early, and they’re all trying hard to pump their bags. Influencers are paid to help raise awareness.

But there are some red flags. They revolve around users asking hard questions. What is the project doing? How’s it different than X, Y, and Z, which are already successful projects doing the same thing? Do you have anything besides a website with a roadmap? Docs?

Even if a team can answer all the hard questions, they can still rug. You. Never. Know. That’s why, at Dypto Crypto, we only use proven projects in our portfolio. While this isn’t financial advice, it’s essential to understand that everything in DeFi carries significant risk, especially when it comes to shiny new things.

Do your due diligence. Use a hardware wallet. And create a new wallet for making “degen” moves in case the worst-case scenario should happen.