At Dypto Crypto, we obviously love crypto. But one thing we’ve never truly cared for is calling BTC “digital gold”. It suggests hodling, which is fine.

But hodling isn’t going to change finance or any other industry, for that matter. We believe that for crypto and blockchain tech to become a long-term staple in the future of finance, tokens have to be spendable like fiat currency.

Gif by cbc on Giphy

Tether is taking it to another level. Flipping the script. Whatever term you prefer, that’s the thing that they’re doing. They want to make tokenized gold spendable just like fiat. The potential impact is nothing short of profound. If your mind isn’t blown yet, keep reading. There was no shortage of interesting crypto news this week. Let’s get after it.

From the Dypto Crypto Newsroom

Tether Unveils a New Product Called Scudo, and It’s an RWA

TLDR

Tether launched Scudo this week, marketing it as the Satoshi of gold.

XAUt is Tether’s RWA that’s backed by gold.

Scudo represents 1/1,000th of an ounce of gold or XAUT.

The goal is to make it gold as easily spendable as fiat or stablecoins.

Gold. It’s shiny, it’s historic, and it doesn’t care about inflation or what the stock market did yesterday. But have you ever tried to buy a coffee with a gold bar? It’s not exactly convenient…or even possible. You can’t exactly shave off a few flakes of metal to pay for your latte.

For a long time, gold has been something you hoard, not something you spend. But Tether, the stablecoin issuer you’ve definitely heard of, is trying to change that narrative. Tether has announced the launch of Scudo. It’s a new product designed to make owning and spending gold as easy as sending a text message.

Here’s why crypto users should care about Scudo.

Tether is known for the USDT stablecoin. But they also have a token called Tether Gold (XAUt), which represents ownership of real, physical gold held in vaults.

The problem? Gold is expensive. Dealing with a whole ounce — or even fractions of an ounce — gets messy when you look at the numbers. Pricing a sandwich at 0.00034 XAUt is a headache for everyone involved. It’s unintuitive, and frankly, looking at that many decimal points is enough to make anyone’s eyes cross. Think of Scudo as a new way to measure the gold you own. One Scudo equals one-thousandth of a troy ounce of gold.

Creating a smaller unit of account removes the mental friction of transacting in gold. Instead of worrying about complex decimals, you can just deal in Scudo. It democratizes access, allowing you to own a piece of the pie without buying the whole bakery.

So, what does this mean for users?

Right now, it means you have a new, easier way to get exposure to gold.

In the long run, Tether is betting that we might actually start pricing goods and services in Scudo. Imagine a freelancer in a country with high inflation asking to be paid in Scudo to protect their earnings. Imagine paying for an international service without worrying about exchange rates, knowing the value is pegged to gold.

TLDR

Sharplink Gaming is setting a precedent for institutional crypto investing.

They’ve staked (and now restaked) the vast majority of ETH holdings.

The results have been impressive — $33 million in rewards in around seven months.

Sharplink Gaming, the world’s second-largest corporate holder of Ethereum (ETH), continues to double down on its strategy to generate passive income through blockchain technology. According to recent data released by the company, Sharplink has earned over 10,657 Ether — valued at approximately $33 million — in staking rewards over the past seven months.

Why DATs staking so much ETH is big news.

Staking could be the future of DAT companies. At Dypto Crypto, we love staking and even use it in our own portfolio.

As Sharplink Gaming and BitMine continue to report earnings from their staking operations, they may be setting a new standard for how companies manage digital assets. The days of passive holding appear to be giving way to an era of active network participation. And that’s a good thing. A really, really good thing (for crypto).

With $33 million earned in seven months and a fresh $170 million deployment into advanced restaking protocols, Sharplink is testing the upper limits of what corporate crypto treasuries can achieve.

Question of the Week

From a new Dypto Crypto Team member - "I find Ethereum staking confusing. How can the price go up when stakers receive rewards? Won't that dilute the token's value?"

Meme of the Week

By the Numbers - The Dypto Crypto Portfolio

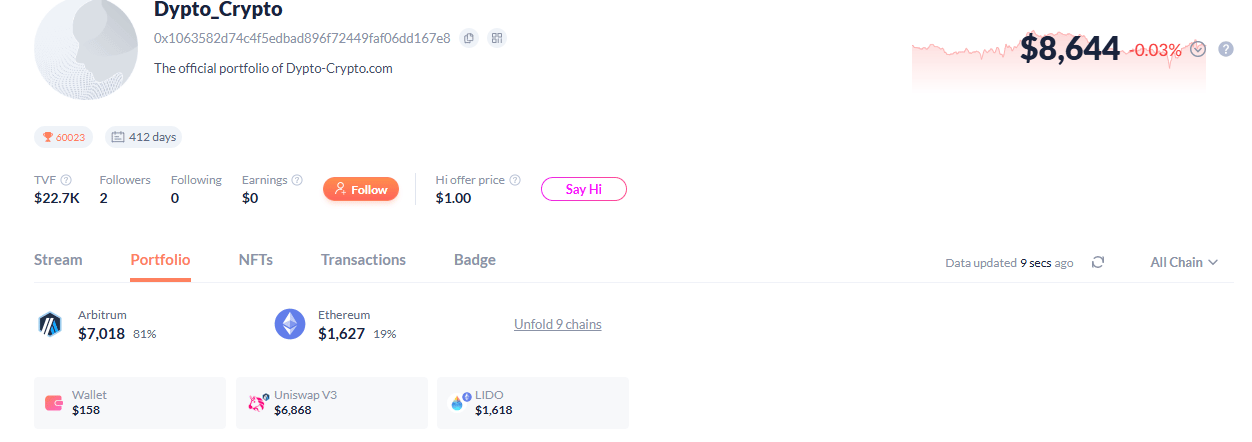

Here’s a screenshot of our portfolio, which we started in late December 2024.

Original portfolio valuation - 3 ETH ($9,670)

2025 portfolio valuation - $8,049 YTD - (-)15%

2026 start - $8,813

Current valuation - $8,644 YTD - (-) 2%

ETH is continuing its crab dance so far in 2026. If we had to guess, we’d say that current political shenanigans have quite a bit to do with that.

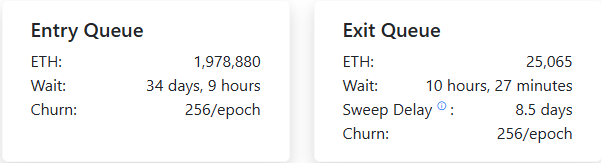

However, there is some good news. Some of the biggest players in the ETH DAT game are staking more and more tokens. On top of that, the ETH validator queue is looking stellar right now. Supply squeeze incoming? We’re watching it closely.

Dypto Crypto CEO, Co-Founder, and lead analyst CJ Miller agreed and added, “Well, 2025 ended up being a little lackluster, and we ended the year slightly lower than we started. Why is that? Well, the portfolio's value is mostly driven by ETH's price, and unfortunately, ETH has been underperforming quite a bit.

The good news is that we've been reinvesting all our fees back into ETH, so the portfolio will benefit quite nicely as it rebounds, while we collect even more fees.

So what's the strategy for 2026? Well, we still have some pretty strong conviction for ETH. The Ethereum Foundation has been making big strides in further updating the blockchain and preparing it for institutional-level use, and we believe we will be seeing A LOT of that starting this year.”

Deep Dive - Happy Genesis Day: Exploring the Genesis Block

On January 3, 2009, a pseudonymous figure known as Satoshi Nakamoto mined the first block of the Bitcoin blockchain. Known as “Block 0” or the “Genesis Block,” the digital event laid the technical and ideological groundwork for the entire cryptocurrency industry.

Every year, the blockchain community observes “Genesis Day” to mark this anniversary. However, beyond the commemorative posts and celebratory memes, the genesis block represents a critical piece of engineering. It serves as the immutable anchor for a decentralized ledger system that has since grown into a trillion-dollar asset class.

In technical terms, a genesis block is the first block ever mined on a blockchain network. It is the foundation upon which every subsequent block is built. For a blockchain to function as a distributed ledger, every new block must contain a cryptographic reference to the block that came before it. This linking process is what creates the “chain”.

However, because the genesis block is the starting point, there are no previous blocks to reference. So the inaugural block is typically hard-coded into the blockchain’s protocol by its creators.

The genesis block initializes the blockchain. It sets the initial parameters, such as mining difficulty and block rewards, which govern how the network operates. Without this secure and reliable foundation, the network would have no way to permanently record transactions using cryptographic hashes. It effectively tells the network software, “Start here”.

Question of the Week Answer

Great question! The short answer is that staking is really just one piece of the puzzle.

Here’s the substantially longer version: When you stake Ethereum, you lock up your ETH to help secure the network and validate transactions. In return, you earn rewards in the form of more ETH. Now, you might wonder: "If more ETH is being created as rewards, won't that make each ETH worth less?"

Not necessarily. Here’s why:

Demand vs. Supply: While staking does increase the total supply of ETH, the price of ETH is driven by demand. If more people want to buy ETH (for staking, using decentralized apps, or other reasons), the demand can outpace the new supply, pushing the price up.

Staking Reduces Circulating Supply: When people stake ETH, it’s locked up and can’t be sold or traded. This reduces the amount of ETH available in the market, which can actually help support or increase the price.

Network Growth: Staking rewards incentivize participation in Ethereum’s ecosystem. A secure and growing network attracts more users, developers, and investors, which can boost ETH’s value over time.

Inflation vs. Utility: While staking rewards add new ETH to the supply, Ethereum also has a mechanism called burning (introduced with EIP-1559). A portion of transaction fees is permanently removed from circulation, helping offset inflation from staking rewards.

Staking rewards don’t automatically dilute ETH’s value. The balance between supply, demand, and Ethereum’s utility as a platform plays a much bigger role in determining its price.