We’ve seen some red candles lately. A lot of red candles, if we’re being honest. But the news that’s rolling in about the crypto industry continues to blow our minds and give us hope.

Gif by starwars on Giphy

There’s a lot that happened this week. Time to get after it.

From the Dypto Crypto Newsroom

Circle Had a Huge Q3 and Gave a Teaser of What’s to Come

TLDR

Circle posted big numbers in Q3 – USDC in circulation doubled, total revenue up 66%, and net income more than doubled.

But what has everyone excited is that the company is exploring a native token for its new Arc blockchain.

Circle, the company behind the popular USDC stablecoin, released its third-quarter earnings report, and let’s just say things are looking pretty good. However, buried in all the impressive numbers was a small nugget of information that has the crypto world buzzing: Circle is considering launching a native token for its new Arc blockchain.

Does the world need a Circle token?

For a company that has built its empire on a stablecoin pegged 1:1 to the US dollar, venturing into the world of native, non-stable tokens is a massive deal. A native token is the primary cryptocurrency of a specific blockchain (like ETH on Ethereum). It’s typically used for things like paying transaction fees, participating in network governance, and securing the network.

Circle believes an Arc token could:

Drive adoption by giving people a reason to use the network.

Align the interests of everyone involved in the Arc ecosystem.

Support the long-term growth of the Arc network.

Being that Arc is an L1, it can’t use ETH or BTC for gas. While we, along with everyone else, assumed that USDC would be used for transaction fees, there are good reasons for exploring a native token. A token could create a built-in incentive system to attract developers, users, and investors to the Arc blockchain, helping it grow and compete with other Layer 1s. It could help build hype. It could open many doors, including incentivizing institutional hodlers, among others.

Crypto Trading Is Officially Back on SoFi

TLDR

After months of waiting, crypto trading has relaunched on SoFi.

The company offered this service years ago, but stopped, and is now relaunching it and preparing to release its own stablecoin.

It’s the first nationally chartered bank to offer crypto trading.

We’ve known for a while that SoFi was bringing crypto back sooner rather than later. The self-proclaimed “digital one-stop shop for your money” has reintroduced crypto trading. But this isn’t an ordinary relaunch. They’ve become the first and only nationally chartered, FDIC-insured bank to offer crypto trading directly to consumers. It’s a pretty big deal.

But why is it a big deal?

Putting “bank” and “crypto” in the same sentence used to be like mixing oil and water. Banks were the old guard, and crypto was the rebellious newcomer. But things are changing, and SoFi is leading the charge.

As the first nationally chartered bank to launch crypto trading, SoFi is bridging a major gap. A recent survey conducted by the platform showed that 60% of SoFi members who own crypto would rather trade with a licensed bank than a typical crypto exchange.

Why? Trust. Knowing your crypto activities are happening on a platform overseen by federal bank regulators adds a layer of confidence that many have been waiting for.

Ready, Set, Launch – Google x Prediction Markets

TLDR

Google is introducing numerous new AI features to Google Finance.

Among them will be information from prediction markets Polymarket and Kalsh.

Other tools will enable investors to utilize AI for in-depth analysis of financial research and earnings.

If you’ve ever found yourself doomscrolling political Twitter or trying to decipher financial news, you’ve probably thought: “Man, I wish I could just bet on this stuff.” Well, you’re not alone.

Prediction markets, where people bet on the outcomes of future events, are gaining traction in the mainstream. And now, the biggest name in tech is getting in on the action.

Google has announced a major partnership with leading prediction markets Polymarket and Kalshi.

Why this is a bigger deal than it sounds.

News articles and expert analyses are great, but they’re often influenced by bias, editorial slants, or outdated information. Prediction markets, on the other hand, provide a raw, live, and financially incentivized consensus.

When new information emerges — a new economic report, a political scandal, a surprise movie nomination — the market reacts instantly. Integrating this into Google Search means you get a dynamic, up-to-the-minute forecast, not a static one.

The Google partnership is the cherry on top of a massive growth period for prediction markets. Polymarket, which has a strong crypto user base, has seen its monthly volume and active traders hit all-time highs.

Question of the Week

From an X DM - “Lots of red lately. When people start selling, what do they do with their money? Because it doesn’t look like anyone is buying much of anything.”

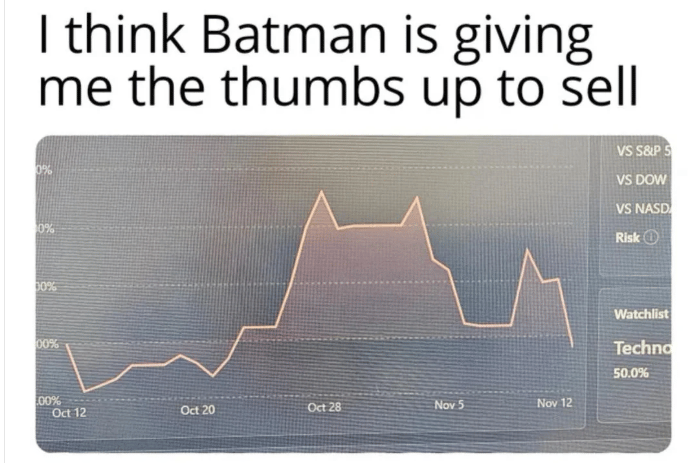

Meme of the Week

By the Numbers - The Dypto Crypto Portfolio

Here’s a screenshot of our portfolio, which we started in late December 2024.

Original portfolio valuation - 3 ETH (~$9,670)

Current portfolio valuation - $8,270 YTD - (-)14.5%

It’s been a brutal couple of weeks. There’s no sugar coating it. Everything is running red right now, from stocks to crypto.

For us, it’s not the time to get scared or make moves. Now is the time, at least with our plan, to hunker down and wait out the red candles. There are green days ahead. We just have to be patient and stay the course.

We do not preach panic selling, so we won’t do it. If anything, we’re hunting for a good spot to buy more.

From our analyst and CEO CJ Miller, “The market is in a very indecisive place at the moment. Investors are holding their breath and seeing what happens next before they make their next move.”

Deep Dive - Highlights From Paul Atkins’ “Project Crypto” Speech

Another day, another regulator talking about crypto. But this time, it hit different.

On Wednesday, SEC Chairman Paul Atkins took the stage at the Federal Reserve Bank of Philadelphia’s Fintech Conference and laid out a new vision for crypto regulation in the US. Dubbed “Project Crypto”, the plan is a shift away from the regulation-by-enforcement approach that has left the industry in a state of confusion for years.

One of the most frustrating parts of the crypto regulation debate has been the question: “Are crypto assets securities?” Atkins sympathized with this frustration, pointing out that “crypto asset” is a technological description, not a legal one. It explains how value is transferred, but it doesn’t define the legal rights associated with an asset.

He made a crucial distinction: most crypto tokens trading today are probably not securities themselves. However, a token might have been sold as part of an investment contract, which is a security. This is a huge deal. For years, the prevailing view among regulators seemed to be that if a token was ever part of a securities offering, it would be considered a security forever.

Chairman Atkins was clear that this new approach isn’t a free pass for bad actors. “Fraud is fraud,” he stated, and the SEC will still go after those who deceive investors. This framework is about providing “integrity and intelligibility” to the market, not abandoning oversight.

He concluded by emphasizing that the SEC’s role is to serve entrepreneurs, investors, and all Americans striving for prosperity. “Project Crypto” is a commitment to do just that — to create rules that are firm, fair, and fit for the digital age.

Question of the Week Answer

Great question. There are several possibilities.

Cash or Stable Assets: Many investors sell their assets to move into cash or cash equivalents like stablecoins (in the crypto world) or money market funds. This is often done to preserve capital during periods of uncertainty or market downturns.

Other Investments: The money might flow into other asset classes perceived as safer or more stable, such as:

Bonds: Government or corporate bonds are often seen as a "safe haven" during market volatility.

Gold and Precious Metals: These are traditional stores of value during economic uncertainty.

Real Estate: Some investors may shift their focus to tangible assets like property.

Paying Off Debt or Expenses: In some cases, investors sell assets to cover personal or business expenses, pay off debt, or meet margin calls (in leveraged trading). This is also the time of year many pro traders and institutions will start tax harvest to reduce capital gains taxes.

It's important to note that the "money leaving the market" is a bit of a misnomer. For every seller, there is a buyer. What changes is the price at which the transaction occurs. The red candles reflect a lower price because sellers are willing to accept less, and buyers are not bidding as high. The money doesn't disappear — it just moves to different places based on the strategies and risk appetites of investors.