Walk into a certain fast-food restaurant in the US (and now El Salvador), and you can get a thick, delicious milkshake. You can get a juicy steak burger. Or maybe splurge and get two of them. That’s the called the Bitcoin Meal.

It comes complete with the BTC logo stamped right on the bun. The best part? You can pay with Bitcoin. Less than a year after launch, Steak n’ Shake’s numbers are impressive. But that’s not all that happened this week. Let’s get after it.

When it all clicks.

Why does business news feel like it’s written for people who already get it?

Morning Brew changes that.

It’s a free newsletter that breaks down what’s going on in business, finance, and tech — clearly, quickly, and with enough personality to keep things interesting. The result? You don’t just skim headlines. You actually understand what’s going on.

Try it yourself and join over 4 million professionals reading daily.

From the Dypto Crypto Newsroom

Bermuda Is Building the World’s First Onchain Economy

TLDR

If you’ve ever vacationed in the Caribbean, you know things are pretty expensive.

That could be about to change in Bermuda, which announced it’s piloting a fully onchain economy.

The initiative is backed by Coinbase and Circle.

When you think of Bermuda, you probably picture pink sand beaches, sitting in a pool with a cocktail with a little umbrella, or maybe that mysterious triangle where planes supposedly vanish into thin air. But while the rest of the world is busy turning it into a conspiracy theory about disappearing ships, this tiny island nation is busy. Busy doing what? Busy making traditional banking vanish.

The Government of Bermuda has announced plans to transform the island into the world’s first fully onchain economy.

How is this a thing?

In the traditional world (we call this offchain), when you buy a coffee with a credit card, that transaction bounces around between payment processors, your bank, the coffee shop’s bank, and card networks. Each stop takes a cut of the cash (fees) and slows things down. It’s like sending a letter through five different post offices before it reaches your neighbor.

An onchain economy moves those transactions onto the blockchain. For Bermuda, going onchain means using digital assets — specifically stablecoins like USDC — as everyday financial infrastructure.

Bermuda isn’t trying to hack this together in a garage. They’ve brought in the varsity team. The first string. The first line. The starting lineup. The Michael Jordans of the crypto space. The government has partnered with two of the biggest, most trusted names in the game:

Circle: The creators of USDC (USD Coin). This is a stablecoin pegged to the US Dollar. One USDC always equals $1. It doesn’t go up and down like Bitcoin, making it perfect for buying stuff without worrying that your coffee will cost $50 tomorrow.

Coinbase: One of the largest and most secure crypto exchanges in the world. They provide the infrastructure (the tech plumbing) to make all this work.

Steak ’n Shake Reports $10M Gain in Bitcoin Reserves

TLDR

Bitcoin is changing the game for fast-food restaurant Steak ‘n Shake.

After being on the brink of bankruptcy for years, the company adopted a BTC treasury strategy and began accepting Bitcoin as payment.

Their growth has outperformed every other major chain in the same class ever since.

Steak ’n Shake has announced a big boost to its corporate treasury. On Friday, the company revealed that its Bitcoin holdings have grown by $10 million in notional value.

The milestone comes less than a year after the chain began accepting BTC as a payment method across its locations.

Why Steak n’ Shake’s story is about being a mover and a shaker rather than a steak and a shake.

The move by Steak ’n Shake provides a case study for the utility of Bitcoin as a medium of exchange. For years, financial analysts and crypto enthusiasts have debated whether Bitcoin is better suited as “digital gold” (a store of value) or “digital cash” (a transactional currency).

And not to mention all of the haters who’ve always screamed “It’s not real money” from the rooftops whenever the price of BTC dropped…

By accepting BTC directly for burgers and fries — and retaining that BTC in their treasury — Steak ’n Shake is testing both use cases simultaneously. The decision showcases growing adoption across the board. It demonstrates that Bitcoin can function effectively for everyday transactions rather than serving solely as a speculative financial instrument.

Question of the Week

A question from TikTok - “Does crypto have seasons?”

Meme of the Week

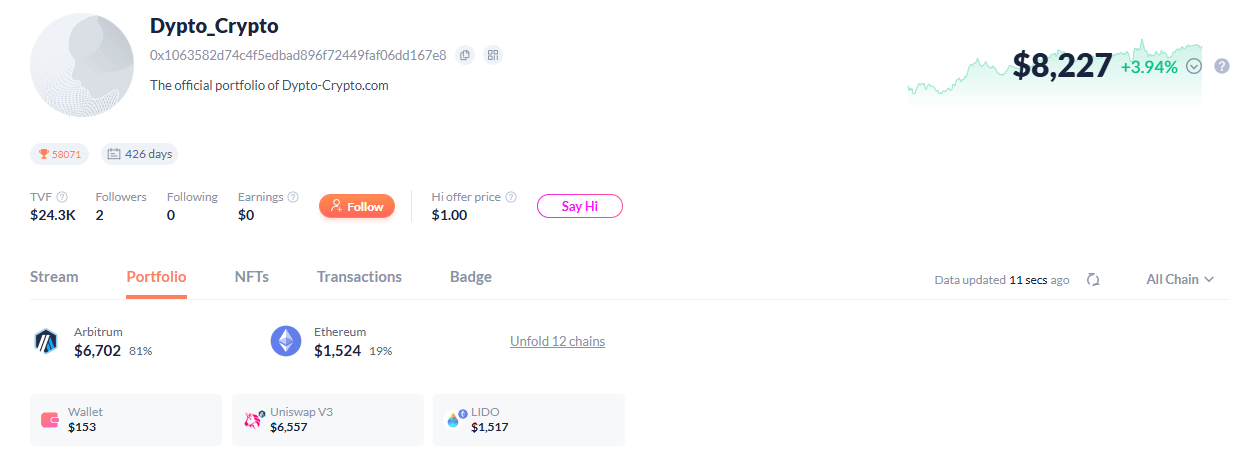

By the Numbers - The Dypto Crypto Portfolio

Here’s a screenshot of our portfolio, which we started in late December 2024.

Original portfolio valuation - 3 ETH ($9,670)

2025 portfolio valuation - $8,049 YTD - (-)15%

2026 start - $8,813

Current valuation - $8,227 YTD - (-)6.5%

We messed up. The market started to pump a bit over the last couple of weeks. And we got excited. Getting excited about super short-term gains as a long-term holder is a noob mistake. And we made it. It happens.

So let this be a lesson to all of you new crypto investors out there. We’ve been in the game for years, and even we still make rookie mistakes. Don’t beat yourself up over them.

Deep Dive - Why Gen Z Trusts Crypto More Than Boomers Do

We’re seeing a massive vibe shift in how different generations view money. A recent OKX survey dropped some serious truth bombs about the generational divide in finance. The headline? Gen Z is effectively leading the charge into the crypto future, while Boomers are sticking to what they know.

According to the data, 40% of Gen Z and 41% of Millennials gave crypto platforms high trust scores (we’re talking 7 out of 10 or higher). Now, compare that to the Baby Boomers. Only 9% of them feel the same way. Younger generations are roughly five times more trusting of crypto than their parents or grandparents.

For Boomers, a bank vault feels safe. For Gen Z, a decentralized ledger that doesn’t charge you an overdraft fee for buying a coffee feels a whole lot safer. The skepticism toward conventional systems among younger users is a direct response to a financial system that often feels rigid and outdated.

For younger generations, the appeal of crypto lies in its utility. When asked what problems crypto solves better than traditional finance, younger participants point to:

24/7 Accessibility: Because money shouldn’t sleep just because it’s the weekend.

Borderless Transfers: Sending money across the world should be as easy as sending a DM (we all know how those young whipper snappers love their DMs, amirite?).

Flexibility: Rigid legacy infrastructure just can’t keep up with a digital-first lifestyle.

Question of the Week Answer

We are sure exactly what this question is asking, because it could be asking two things. Both are great and deserve an answer. We’ll start with the crypto-native answer first.

In crypto, a “season” is a short-term narrative. So if you hear someone say something like “it’s meme season”, that means they think that meme coins will be pumping for the short term, or depending on the broader crypto market, outperforming blue chips in the short term.

As a recent winter storm has laid waste to several states in the southeastern US, this question could relate to how actual weather seasons can impact the crypto industry. Here are a few factors that can impact crypto that won’t matter to many other financial markets. At least, not as a whole.

Cryptocurrencies like Bitcoin rely on energy-intensive mining processes. Harsh winter weather can increase heating demand, leading to higher electricity costs. This could make mining less profitable, especially for miners operating on tight margins, potentially reducing mining activity.

Snowstorms and ice can also cause power outages, disrupting mining operations and reducing the hash rate (the computational power of the network). A significant drop in hash rate can affect network security and market sentiment.

While winter weather alone is unlikely to be a primary driver of crypto market trends, it can still have indirect effects that contribute to short-term volatility.