You walk into a financial advisor’s office. You have a mil to drop, and you want to put 20% of it, split evenly, into ETH and BTC. The advisor gives you a smug look before telling you that he doesn’t deal with scams.

You stand up, walk out, and go buy a Ledger instead. That’s exactly what many younger, high-net-worth individuals are doing right now, according to a new report from zerohash. But that’s not all that happened this week. Let’s get after it.

From the Dypto Crypto Newsroom

Your Financial Advisor Should Probably Read This Report

TLDR

A new report from zerohash finds that more and more people are investing in crypto.

The problem? Many financial advisors are not offering that service.

The result has been many young investors, including high-net-worth individuals, jumping ship to manage their own portfolios or to find advisors who offer the services they want.

What if your trusted financial advisor — the person who helps you with stocks and retirement plans — suddenly started talking about Bitcoin? What if they didn’t? Would you stick with them?

A recent study commissioned by zerohash, a crypto-as-a-service platform, surveyed 500 US investors aged 18-40 and found a huge shift in how younger, affluent people view crypto. They see it as a core part of building wealth.

FAs need to get with the program or get left behind.

While young investors are diving headfirst into crypto, most are doing it on their own. The zerohash study revealed that 76% of crypto holders manage their digital assets independently, without a financial advisor.

Why? Because most advisors simply haven’t caught up. They don’t offer crypto services, and this inaction is costing them. A whopping 35% of investors have already moved money away from advisors who don’t offer crypto exposure. We’re not talking about pocket change, either. More than half of those who left moved between $250,000 and $1 million.

Kraken’s Going Public. Kinda. Probably. Here’s What We Know

TLDR

Kraken announced that it has filed an S-1 form with the SEC — essentially, that means the company wants to go public.

Securitize recently announced that it also intends to go public. Other crypto companies that have recently gone public include Gemini and Bullish.

Kraken has not released any official information regarding the stock price or date.

Kraken is one of the biggest centralized exchanges in the US. The big news? Kraken has announced it’s taking steps to go public with an Initial Public Offering (IPO).

Release the kraken! (They’re working on it)

On November 19, 2025, Kraken dropped a press release stating it had “confidentially submitted a draft registration statement on Form S-1 with the US Securities and Exchange Commission (the ‘SEC’).”

Let’s translate that to human-speak.

“Confidentially submitted”: The company has filed its IPO paperwork with the SEC, but they’re doing it on the down-low for now. The Jumpstart Our Business Startups (JOBS) Act allows certain companies to file confidentially to test the waters with regulators before making a big public splash. It keeps their financial details private until they’re closer to the actual offering.

“Form S-1“: The official document a company must file with the SEC to go public. It’s the company’s tell-all book, containing everything from its business model and financial statements to potential risks. The SEC reviews this document very, very carefully.

Kraken also noted that “the number of shares to be offered and the price range for the proposed offering have not yet been determined”. This is standard procedure. The final details will be sorted out later, depending on how the SEC review goes and what the market looks like.

Explaining Uniswap’s New Continuous Clearing Auctions

TLDR

Uniswap has released continuous clearing auctions.

The feature will help facilitate fairer launches for retail users and hopefully reduce pump-and-dump trading of new tokens.

Uniswap, the king of decentralized exchanges, has launched a new feature called Continuous Clearing Auctions (CCA). It sounds fancy, complicated, and maybe a little intimidating. You might be thinking, “Great, another crypto thing I have to pretend to understand”.

And we get that. But if you’re in crypto, or want to be, you have to know that the things going down in the DeFi world today will be in the TradFi world tomorrow.

How we know: Prediction markets. And that’s only the latest example.

Breaking down CCAs.

Continuous Clearing Auctions (CCA) are a new, permissionless way for crypto projects to sell their tokens and figure out a fair market price. Think of it as a super-organized, public sale that runs automatically on the blockchain.

The “continuous clearing” part is the secret sauce. Instead of a single, chaotic moment where everyone tries to buy at once, the auction happens block by block over a set period. This process helps prevent bots from snatching everything up in the first five seconds and gives the market time to breathe and find a stable price.

At the end of the auction, the money raised is automatically used to create a brand-new liquidity pool on Uniswap v4. The token immediately has a market where people can start trading it, avoiding the liquidity crunch that plagues so many new projects.

Question of the Week

A YouTube Comment - “Do you guys think a bear market is starting?”

Meme of the Week

By the Numbers - The Dypto Crypto Portfolio

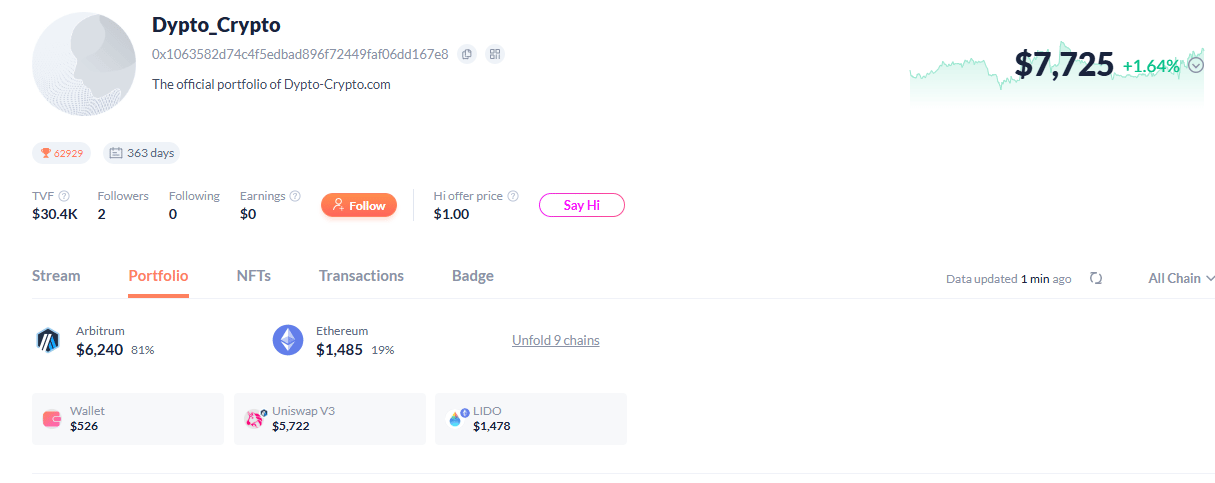

Here’s a screenshot of our portfolio, which we started in late December 2024.

Original portfolio valuation - 3 ETH (~$9,670)

Current portfolio valuation - $7,725 YTD - (-)20%

Not much to say this week. Things are looking quite bearish right now. Does that change anything for us? No. Our strategy is built with volatility in mind.

The last bear market was so bad that it earned the name “crypto winter”. We made it through that. We’ll make it through this one. The difference? We’re ready.

Deep Dive - Here’s Why Decentralization Matters Now More Than Ever

Centralization is like a traditional kingdom. You have one ruler (a king, a CEO, a single server) who makes all the decisions. That central authority controls everything. Most of the systems we use every day are centralized, from finance to social media and the internet as a whole.

Centralization can be efficient. It’s often faster and simpler to have one entity in charge. But it also creates a single point of failure. If the king gets sick, the whole kingdom is in chaos.

The tech world got a few loud wake-up calls recently. Earlier this month, a Cloudflare outage sent major platforms like X, ChatGPT, and others into a nosedive.

Cloudflare is a company that provides security and performance services for a massive chunk of the web. It admitted a bug in their own system caused the widespread failure. It wasn’t a cyberattack — just a tiny software hiccup with a gigantic ripple effect.

Just a month earlier, in October, Amazon Web Services (AWS) had its own meltdown. AWS is the biggest cloud provider on the planet, and when it went down, so did thousands of apps and websites (including many DeFi projects that host on AWS — the irony wasn’t lost on us).

Microsoft wasn’t spared either, with its Azure cloud service experiencing a similar DNS-related outage that took down services from Xbox Live to Starbucks.

In each case, the problem stemmed from a single, centralized point of failure. These outages are more than just an inconvenience. They show how fragile our centralized digital world has become.

Decentralization is the answer.

Question of the Week Answer

We can’t say for sure. As unfortunate as it is, we are not fortune tellers. But we’ve danced this dance before, and the market is starting to have that familiar scent of bearishness.

So, why we can’t tell you if it’s a bear market for sure, we can give you some tips on how to prepare for one if that’s what your gut is telling you.

1. Assess Your Financial Situation

Have Funds on Deck: Set aside a fund to buy the dip. It provides capital ready for deployment without you having to wait for a paycheck.

2. Reevaluate Your Portfolio

Quality Investments: Focus on high-quality blue chips and projects that are more likely to weather economic downturns.

3. Stick to Your Plan

Avoid Emotional Decisions: Bear markets can be emotionally challenging, but avoid panic selling. Stick to your long-term investment strategy.

Dollar-Cost Averaging: Continue investing regularly, even during downturns, to take advantage of lower prices.

4. Focus on the Long Term

Historical Perspective: Remember that bear markets are a normal part of the market cycle and are often followed by recoveries.

Opportunities: Use the downturn to identify undervalued assets that could perform well in the long run.

5. Maintain a Healthy Mindset

Stay Calm: Avoid making impulsive decisions based on fear.

Education: Use the time to learn more about crypto, investing, and market cycles to build confidence in your strategy.