What? Full blockchain? We can’t be serious. The US government would never allow such a thing.

Gif by BenJammins on Giphy

For years, that was certainly the case. But the G-men are singing a different tune these days. Let’s get after it.

From the Dypto Crypto Newsroom

SEC and DTCC Pave the Way for Tokenized Assets

The DTCC has received a no-action letter from the SEC to explore using blockchain tech to tokenize real-world assets.

A no-action letter means the SEC won’t pursue any kind of legal action against the DTCC.

Plans are already underway, with a rollout planned for the second half of 2026.

The line between TradFi and crypto continues to blur. In a move that feels like seeing your grandparents sign up for TikTok, the heavy hitters of the US financial system are officially moving onchain.

The Depository Trust & Clearing Corporation (DTCC) — the massive, invisible engine room that keeps the US stock market running — has received a No-Action Letter from the US Securities and Exchange Commission (SEC).

What is a no-action letter, and why is it important?

If you’re new to this space, a No-Action Letter might sound boring, but in the regulatory world, it’s a golden ticket. The SEC is saying, “Go ahead and try this new tech; we won’t sue you”. If you’ve been around crypto for a while, you know that:

Not too long ago, everyone was being sued.

Not being sued is a good feeling.

This specific ticket enables the DTCC to begin tokenizing real-world assets, such as US Treasury bills and major stock indexes. Blockchain tech is becoming the future infrastructure of the entire global economy.

Banks Get Green Light for Crypto Trades From the OCC

TLDR

The OCC has officially told the nation’s banks that they can make crypto trades on behalf of customers.

What’s the mean? You tell your bank you want one Bitcoin. They say ok. They go, buy it, and sell it to you for the same price they paid. The customer doesn’t deal with exchanges or need a wallet. The bank is the middleman.

The OCC head, Jonathan Gould, recently spoke at a blockchain conference and said that crypto trades and transactions should be treated the same as every other banking service.

Big news dropped this week that might just bridge the gap between your dusty old savings account and your shiny new crypto wallet. The Office of the Comptroller of the Currency (OCC) — the boss of national banks in the US — released a letter stating that national banks can now act as middlemen for crypto trades.

Why this is a big win for crypto users (especially beginners).

1. The Trust Factor - Banks have their issues, but they are heavily regulated. If you’re nervous about hacks or exchanges disappearing into the night, doing business through a national bank offers a layer of comfort. As the OCC letter noted, this allows you to transact “through a regulated bank, as compared to non-regulated or less regulated options”.

2. Convenience Is King - For many people, the biggest hurdle to crypto trades and buying crypto has always been the hassle. Setting up new accounts, verifying ID, linking bank accounts — it’s a lot. If your current bank starts offering this, you could theoretically buy Ethereum right alongside paying your electric bill.

3. Legitimacy Boost (It’s Over 9,000!) - When the OCC says something is part of the “business of banking,” it’s saying that crypto is becoming a standard part of the financial plumbing (more or less). This could lead to more stability and better services down the road.

Question of the Week

X DM - “The market is slumping, but the US government and major corporations are still using blockchain. Why?”

Meme of the Week

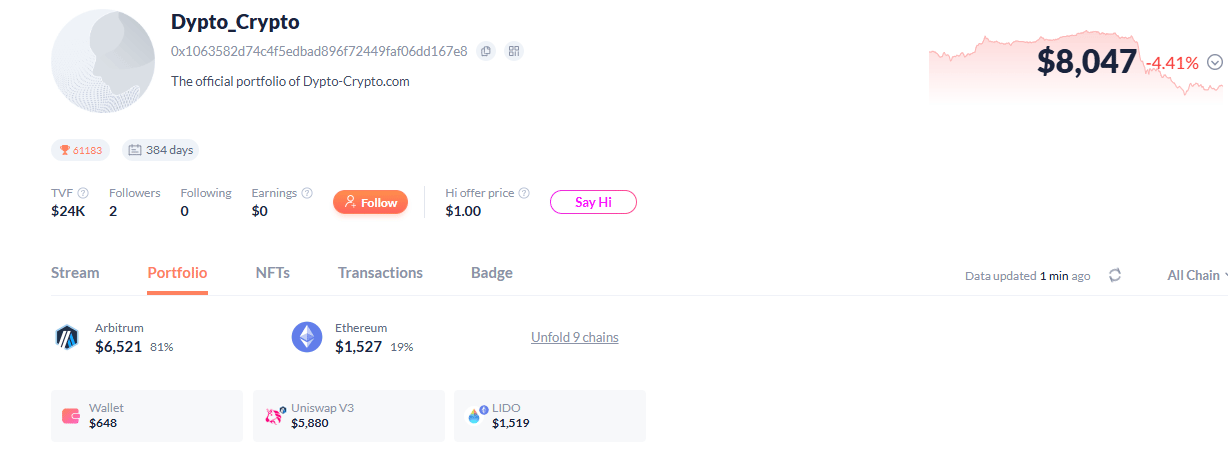

By the Numbers - The Dypto Crypto Portfolio

Here’s a screenshot of our portfolio, which we started in late December 2024.

Original portfolio valuation - 3 ETH ($9,670)

Current portfolio valuation - $8,047 YTD - (-)16%

Welp…things were looking up last week. Then the US markets opened up on Monday morning, and this happened…

Not much to really add here. We’re staying the course and still trying to figure out whether this is a short-term slump or a slide into a bear market. Right now, we don’t like how things are looking.

For the most part, our strategy stays the same in both a sideways or down market. We may change that a bit depending on how things go, but this portfolio is designed to be relatively hands-off, so we’re not thinking of making any major changes.

Deep Dive - Is ETH Ripe Enough for a Supply Squeeze?

While the price of ETH has been doing a bit of a crab dance or outright headed south for the winter, something interesting is happening behind the scenes. The amount of ETH available on exchanges has dropped to an all-time low. This has got a lot of crypto nerds whispering about a potential supply squeeze.

A supply squeeze happens when the available, liquid supply of an asset drops significantly. When there’s less of something to go around, even a small increase in demand can have a big impact on the price. With so little ETH available to buy on exchanges, any new wave of buyers could find themselves fighting over a shrinking pile, pushing the price upward.

The percentage of ETH held on these exchanges recently hit a historic low of 8.7%. That’s the lowest it’s been since Ethereum was a wee baby back in 2015. Since July, the amount of ETH on exchanges has plummeted by 43%.

The evidence suggests that something big is brewing for Ethereum. The shrinking supply on exchanges, coupled with growing utility across the ecosystem, creates a compelling case for a potential supply squeeze. We’re watching closely and will update as we see things happening.

Question of the Week Answer

Great question. The short answer is: Blockchain tech and crypto are not mutually exclusive.

The longer answer: Blockchain technology enables systems to operate much faster and more cheaply than legacy systems currently in use.

For example, the COBOL system, according to IBM, “supports 80 percent of in-person credit card transactions, handles 95 percent of all ATM transactions, and powers systems that generate more than USD 3 billion of commerce each day”.

That system was developed in 1959.

Considering how many people wait in line to get the latest iPhone the day it comes out, we’re a little surprised that they still rely on tech that’s 65 years old for something as important as their finances…

The crypto market has little impact on blockchain efficiency. So whether BTC is up or down, it won’t take away from the fact that the tech is better for what many people want to use it for.