Nothing like a fresh piece of legislation to make the markets a little crazy, eh? GENIUS was something that needed to get passed to finally give the industry the legitimacy it needs to really take off.

But some people aren’t happy about it.

Gif by abcnetwork on Giphy

The funny thing is that it’s having a positive impact on another part of the crypto market, so there’s good news all around.

Let’s get after it.

From the Dypto Crypto Newsroom

The House Sends GENIUS to Trump – But That’s Not All

TLDR

The House passed the GENIUS Act today!

They also passed the CLARITY Act and the Anti-CBDC Surveillance State Act.

While not everything in these bills will be great for crypto investors, these pieces of legislation are needed to help the industry grow and achieve mainstream adoption.

We got a massive win today. On top of that, we can finally stop holding our breath, which we’ve been doing for too long. After months of political shenanigans, the House of Representatives has passed the GENIUS Act with overwhelming bipartisan support, sending it straight to President Trump’s desk.

Why all this legislation matters to the industry and users.

Clear regulations mean you don’t have to worry as much about sudden regulatory changes tanking your investments. When rules are predictable, markets tend to be more stable.

Registration requirements and oversight mean the exchanges and services you use will have to meet higher standards. It will hopefully reduce the risk of scams and rugs.

As crypto becomes more legitimized through regulation, traditional financial institutions will offer more crypto services. This could mean easier ways to buy, sell, and store digital assets.

Trump Signs the GENIUS Act into Law

TLDR

After months of planning, debate, and scrutiny, the GENIUS Act is officially law.

It regulates stablecoins, requiring audits and protecting users.

It’s the first crypto law on the books in the US.

President Trump just made history by signing the GENIUS Act into law. The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act is a big deal for anyone interested in digital currency.

The government is finally creating a clear rulebook for a game that’s been played without official rules for years. This new law specifically focuses on stablecoins — which are the OG RWA and represent established currencies like the USD in crypto form.

A quick look back at how we got here…finally.

The GENIUS Act didn’t happen overnight. It passed the House with a strong bipartisan vote of 308-122 and cleared the Senate by a 68-30 margin back in June.

The president has made it clear that his administration plans to position the United States as the global crypto capital, promising that future regulations will be “written by people who love your industry, not hate your industry.”

For a long time, we didn’t know if he would keep his crypto promises. But he has kept them all so far. The proof is in the pudding, as they say.

Block Joins the S&P 500 – What It Means For BTC and Crypto

TLDR

Block has officially joined the S&P 500.

It’s the second Bitcoin Treasury Company to do so in the last few months.

Square will begin accepting BTC as payment by the end of the year.

Jack Dorsey’s financial powerhouse Block has scored a big win for itself and the crypto industry. The company behind Square and Cash App is officially joining the S&P 500. It’s huge news for anyone who dreams of buying a coffee with Bitcoin or envisions a world where crypto payments are as commonplace as tapping your card.

Bitcoin + Square = Big Deal

Block recently announced they’re rolling out native Bitcoin payments on Square, starting later this year. Your local coffee shop, boutique, or food truck could soon accept Bitcoin payments as easily as they accept your credit card.

The magic happens through something called the Lightning Network (A Bitcoin Layer 2), which makes Bitcoin payments almost instant and super cheap. You’ll scan a QR code at checkout, and boom — you’ve just bought your lunch with Bitcoin. No complicated wallet setups, no waiting for confirmations, no headaches.

Question of the Week

A YouTube comment - “What are some terms that I should know getting into crypto? One's specific to trading and DD.”

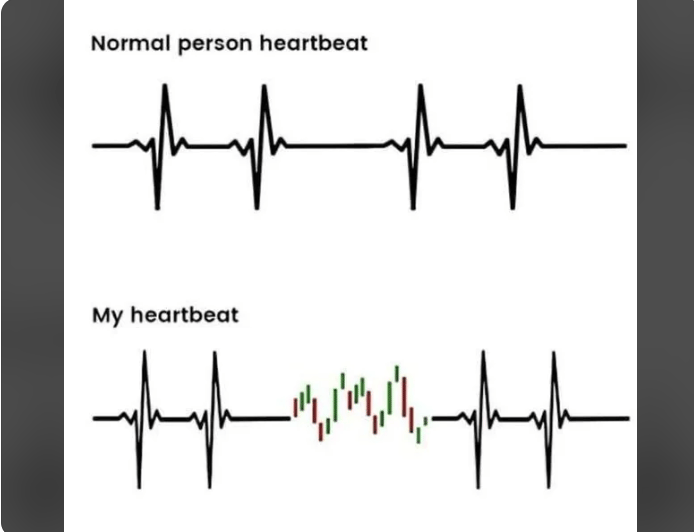

Meme of the Week

Deep Dive - The GENIUS Act Pushes Some Crypto Users Back to DeFi

You can’t make all of the people happy all the time. And right now, something is happening in crypto that is a prime example of that. The GENIUS Act, signed into law by President Trump last Friday, has done a lot for the industry. Not all of it is well-received or loved by crypto holders, such as the ban on yield-bearing stablecoins in the US.

The ripple effects are already being felt. We should have seen this one coming. Alas…we did not. While some view the bill as a necessary step toward regulation (including Dypto Crypto), others are now scrambling to find alternatives for generating passive income. The result? A massive migration back to decentralized finance (DeFi) platforms.

The migration is already showing up in the numbers. Ethereum has seen massive institutional buying. Meanwhile, Ethereum exchange-traded funds (ETFs) attracted $2.2 billion in just five trading sessions — more than double the previous week’s inflows.

Ethereum is having a moment. And we don’t hate it. The cryptocurrency has gained approximately 25% over the past week, pushing toward the $4,000 mark and increasing its market cap to around $450 billion.

Question of the Week Answer

Our kind of question. Here are some of our top picks for where we begin our research into tokens or projects.

1. Market Cap (Market Capitalization)

What it is: The total value of a cryptocurrency. It’s calculated by multiplying the current price of a coin by its circulating supply.

Why it matters: It helps gauge the size and popularity of a cryptocurrency. Higher market cap coins (like Bitcoin or Ethereum) are generally considered more stable than smaller ones.

Example: If a coin is priced at $10 and there are 1 million coins in circulation, the market cap is $10 million.

2. FDV (Fully Diluted Valuation)

What it is: The total value of a cryptocurrency if all possible coins or tokens were in circulation.

Why it matters: It shows the potential future value of a project but can also highlight risks if a large number of tokens are yet to be released.

Example: If a token has a max supply of 10 million coins and the current price is $5, the FDV is $50 million — even if only 1 million coins are currently circulating.

3. Circulating Supply

What it is: The number of coins or tokens currently available and circulating in the market.

Why it matters: It’s used to calculate market cap and gives insight into how much of the total supply is already in use.

4. Total Supply

What it is: The total number of coins or tokens that currently exist, including those locked or reserved.

Why it matters: It’s different from circulating supply and helps you understand how much of the supply is yet to be released.

5. Tokenomics

What it is: The economic model of a cryptocurrency, including its supply, distribution, and incentives.

Why it matters: Understanding tokenomics helps you evaluate the potential value and sustainability of a project.

Closing Shenanigans

Thanks for reading. Dypto Crypto is a safe place where crypto newbies can learn and ask questions to help them make informed decisions in this exciting and volatile world. We’re having a lot of fun with YouTube shorts and TikTok.

So check out those videos and some of our website's tools. Feel free to ask questions on our social platforms or the site. Thanks for subbing! We’ll see you next week. We hope you guys are enjoying the newsletter, and we’d appreciate some feedback. Feel free to reach out on social media and let us know how we did on the first try.