We know stablecoins are boring to most people. But when a16z drops a crypto report showing $4 trillion in annual volume, we’re ok with boring. We like to eat…and we’ll take everyone’s lunch.

Between that report and recent happenings that continue to blur TradFi and crypto, this week had us packing lunchboxes super full. Time to get after it.

From the Dypto Crypto Newsroom

Highlights From a16z’s 2025 Crypto Report

TLDR

The annual a16z crypto report is here.

Stablecoins are going bonkers, AI is finding its place, and it’s all being driven by regulatory clarity.

Andreessen Horowitz’s (a16z) annual State of Crypto report is a big deal. These folks have been backing crypto startups since the early days. They’re the ones who blew the whistle on Operation Chokepoint. So when they drop their yearly insights, the entire industry pays attention.

Their 2025 report has some genuinely exciting stuff packed in it. Some we knew. Some we didn’t. And all of it could make crypto way more accessible.

Crypto is the future (according to the report, but we already knew that).

The trends in a16z’s 2025 crypto report paint a picture of crypto becoming more accessible, stable, and user-friendly. But what should you actually do with this information?

Start Small and Safe: With stablecoins becoming more mainstream and infrastructure improving, there’s never been a better time to start with small amounts. Consider beginning with a stablecoin like USDC to get comfortable with wallets and transactions.

Explore AI-Powered Tools: As AI agents become more common, look for platforms that use AI to simplify crypto management. These tools can help automate tasks that would otherwise require deep technical knowledge.

Take Advantage of Better Apps: The new generation of crypto applications focuses on user experience. Try apps that integrate crypto into activities you already enjoy, like gaming or social media.

Two Brand New Solana ETFs Have Hit the Market

TLDR

Two Solana ETFs have launched this week.

The first, by Bitwise, has the ticker BSOL. The Grayscale product was given the ticker GSOL.

Both products tap into staking to maximize investor profits.

Two major players — Bitwise and Grayscale — launched Solana ETFs this week, marking a huge milestone for one of the fastest-growing blockchains out there.

If you’re wondering how to get exposure to Solana without actually buying and storing SOL tokens yourself, these new ETFs might be exactly what you’ve been waiting for.

Here’s why these Solana ETFs hit different.

Here’s where these ETFs get really interesting: staking rewards. Unless this is your first article at Dypto Crypto, you know we love staking. That’s why we do it with our own portfolio. When you buy Solana directly, you can “stake” your tokens to help secure the network and earn rewards — currently averaging around 7% annually.

Both BSOL and GSOL handle this staking automatically. Your ETF shares benefit from both the potential price appreciation of SOL tokens and the steady income from staking rewards. It’s like owning a stock that pays dividends, except the “dividends” come from helping maintain a blockchain network.

Grayscale plans to pass through 77% of staking rewards to investors after expenses. Bitwise hasn’t specified its exact percentage yet, but it has emphasized maximizing shareholder rewards.

Tokenize Everything – A Securitize IPO Is on the Way

TLDR

Securitize is going public.

The company is best known for partnering with BlackRock to create the investing giant’s BUIDL fund.

The valuation the company is looking for? A cool $1.25 billion. Too high? We’ll let you be the judge.

Securitize, the company that has been quietly tokenizing billions of dollars’ worth of real-world assets, is about to go public with a whopping $1.25 billion valuation. And honestly? It’s about time the market recognized what this company has been building.

Why the IPO matters for crypto users.

Securitize represents something much bigger: the maturation of blockchain tech as a tool for traditional finance. While other crypto companies have focused on creating entirely new financial systems, Securitize has been quietly working to improve the existing system using blockchain.

The company operates as a fully regulated platform with SEC-registered entities across multiple areas: transfer agent, broker-dealer, alternative trading system (ATS), investment advisor, and fund administration. In simple terms, they’ve built all the regulatory infrastructure needed to make tokenization legitimate in the eyes of traditional finance.

This regulatory approach matters because it shows that crypto companies can work within existing frameworks rather than trying to replace them entirely. For new crypto users, this provides a level of security and legitimacy that pure DeFi platforms often can’t match.

Question of the Week

From a DM on X - “Watching the crypto market after the Fed lowered rates and there wasn't much volatility. Many reports are saying the rate drop had already been "priced in". What does that mean?”

Meme of the Week

Dypto Crypto team members at Thanksgiving Dinner…

By the Numbers - The Dypto Crypto Portfolio

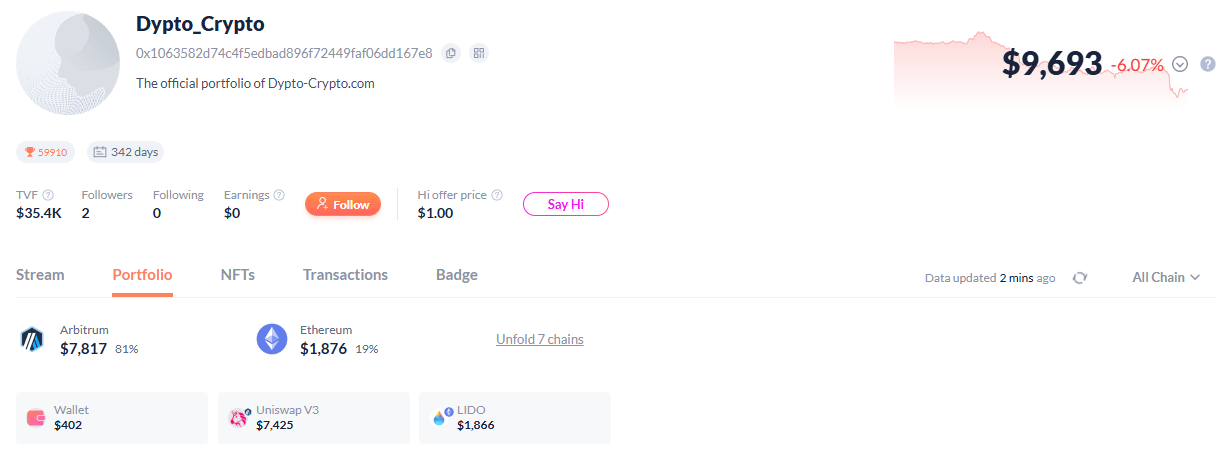

Here’s a screenshot of our portfolio, which we started in late December 2024.

Original portfolio valuation - 3 ETH (~$9,670)

Current portfolio valuation - $9.673. Growth - Not much YTD

Ok. We admit it. We did not smile when we checked out our Debank this morning. However…we did make a noise.

What else were we going to do? The crypto market is down across the board today, from stocks to token prices. Even BNB (which we aren’t currently holding) has dropped back below a grand after running hot all October. However, the volatility isn’t necessarily a bad thing. Here’s how CJ, our CEO and analyst, put it in his most recent portfolio update on the Circle platform.

“If ETH’s price goes below our bottom range, we are buying more and more ETH. The kicker is that we are buying ETH at a lower price every time.

Not only that, but we’re also reinvesting the fees we earned back into our position. These fees are in ETH and USDC. This is why LPers (liquidity providers) like to see movement in both ways, up and down.

Because it creates volatility, and thats where we earn the most fees.

Because it gives us an opportunity to buy low, sell high.

So then why is it important that we have more ETH, even though our valuation is lower? Well think about when ETH’s price goes back up. We now have 0.1 more ETH so as the price goes back up, we have more ETH to sell at a higher price, AND we’re also making more in fees because our overall position is larger.”

Deep Dive - Arc Testnet is Live – Inside Circle’s New Layer 1 Blockchain

You’ve probably heard of Circle. They’re the company behind USDC, the popular stablecoin that’s pegged to the US dollar. We’ve known they were working on their own chain for a few months. The public testnet for their new Layer 1 blockchain, Arc, is now live.

To break it down in its simplest form, Circle is building its own superhighway called Arc, and launching a “testnet” is like opening it to a select group of drivers (in this case, developers and large companies) to take it for a spin before it opens to everyone.

Imagine the internet is like a giant, busy city. Blockchains like Ethereum and Bitcoin are like the first major highways built in that city. They work, but they can get congested and expensive, especially during rush hour. A Layer-1 blockchain is like building a brand-new, super-efficient highway system from scratch to solve those traffic jams.

At its core, Arc is a brand-new Layer-1 blockchain designed to be an “Economic Operating System” for the internet. That sounds fancy, but the goal is simple: make it easier, faster, and cheaper for businesses and developers to move money and create financial applications online.

Think about how you pay for things now. You use credit cards, bank transfers, or apps like PayPal. These systems are often slow, have high fees (especially for international transfers), and involve a bunch of middlemen. Arc wants to build a new foundation for finance directly on the internet, using the power of blockchain to cut out the friction.

Question of the Week Answer

When people say that a rate drop (or any other anticipated event) has already been "priced in," they mean that the market had already anticipated the event and adjusted asset prices accordingly before the official announcement was made.

In other words, traders and investors expected the Federal Reserve to lower rates, and they made their buying or selling decisions based on that expectation ahead of time.

Here’s how it works:

Market Expectations: Financial markets are forward-looking, meaning they try to predict future events and react to them in advance. If there’s widespread speculation or strong signals that the Fed will lower rates, investors may start adjusting their portfolios before the announcement.

Price Adjustments: For example, in the crypto market, if traders believe a rate cut will make riskier assets like cryptocurrencies more attractive (due to lower yields on traditional investments), they might start buying crypto ahead of the announcement. This buying activity pushes prices up before the rate cut actually happens.

No Surprise, No Volatility: When the rate cut is finally announced, it doesn’t come as a surprise because the market had already factored it into prices. As a result, there’s little to no additional movement or volatility in the market.

In your case, the lack of volatility in the crypto market after the Fed’s rate cut suggests that traders had already anticipated the move and adjusted their positions beforehand. The announcement simply confirmed what they already expected, so there wasn’t a big reaction.

This concept applies to all financial markets, not just crypto, and is a key reason why unexpected events (those not priced in) tend to cause much larger market reactions.