Publicly traded crypto companies have been releasing Q3 earnings reports over the last few weeks. The numbers we’re seeing are staggering, especially in the exchange and brokerage space.

Unfortunately, we had a stark reminder that crypto isn’t all sunshine and rainbows. Let’s get after it.

From the Dypto Crypto Newsroom

Banco Inter and Chainlink Make International Trade Easier

TLDR

Chainlink is helping make international trade easier, cheaper, and faster.

A new project used Chainlink’s technology for a transaction between a bank in Brazil and one in Hong Kong.

Not only will using blockchain for imports/exports save money, but it also makes things easier and safer for all parties involved and will allow smaller businesses to enter international markets.

If you’ve been keeping an eye on crypto news/drama, you’ve probably heard a lot about blockchain solving “real-world problems”. Or as we like to call it…use cases. Chainlink, once again, is showing the world how it’s done.

Banco Inter and Chainlink have pulled off something remarkable with the central banks of Brazil and Hong Kong. They completed the first-ever blockchain-based international trade finance experiment that could change how businesses around the world buy and sell goods.

Why the latest Chainlink project matters.

Traditionally, international trade is complicated, expensive, and slow. Banks have to coordinate manually with shipping companies and other financial institutions. There’s a lot of paperwork, delays, and risk involved. And as we all know, the speed of business is fast, but the speed of TradFi…is not…

For small and medium-sized businesses (SMBs), these barriers often make it hard to compete in global markets.

The new platform changes the game by using tokenized payments and smart contracts. The process becomes faster and more cost-effective with permissionless smart contracts. Small businesses can now sell commodities abroad without jumping through endless hoops or paying massive fees. It opens doors that were previously closed.

Coinbase Crushes Q3 – Highlights From the Earnings Call

TLDR

Coinbase recorded $1.9 billion in revenue for Q3.

Volume was up 37% on the retail side and more than doubled on the institutional side.

As far as individual tokens, stablecoins are taking over the industry, and Ethereum trading is gaining momentum.

Coinbase has dropped its third-quarter earnings, and honestly? The numbers are looking pretty sweet. While every earnings call in the history of publicly traded companies highlights the positives, this one backs up the crypto news we’re seeing everywhere.

And what news is that? Crypto is taking off. It’s getting serious.

Overall, this is amazing news for crypto users.

Coinbase’s strong Q3 shows the platform is stable, growing, and investing in features that’ll make your crypto experience better. They’re adding more assets, improving security, expanding payment options, and building tools that’ll make it easier to start small and grow your portfolio over time.

The crypto market is heating up, and Coinbase is positioning itself as the beginner-friendly gateway.

Robinhood's Q3 2025: A Crypto Gold Rush Story

TLDR

Robinhood saw crypto revenue explode over the last year.

Their new Q3 report shows an increase in revenue, to the tune of over 300%.

The numbers were fantastic across the board, with overall revenue coming in at over $1 billion.

Robinhood’s Q3 report has some seriously impressive numbers, and if you're new to the crypto game, this is your wake-up call. The trading platform isn't just growing — it's absolutely crushing the game. Revenues doubled year-over-year to hit a record $1.27 billion.

What does this have to do with crypto? Good question. And we’ve got the answer you want to hear. Cryptocurrency revenue skyrocketed over 300% compared to last year. That's not a typo. While traditional markets did well, crypto absolutely stole the show.

Why is crypto taking off so hard on platforms like Robinhood (and Coinbase)?

So what's driving this crypto boom? Several factors are at play.

First, Robinhood made crypto trading dead simple. You don't need to be a blockchain expert or understand complex wallet addresses. The platform stripped away the technical barriers that once kept beginners out of the market.

Second, they expanded their offerings. Through their acquisition of Bitstamp, Robinhood now offers crypto perpetual futures across Europe and over 400 Stock Tokens to EU customers. They're also rolling out institutional-grade services, legitimizing crypto for more conservative investors.

Third, market conditions are right. With crypto values climbing and media coverage increasing, more people are curious about digital assets. Robinhood positioned itself perfectly to capture this wave of new users.

Question of the Week

A YouTube Comment - “What does the Balancer exploit mean for DeFi and for users? It is time to bail?”

Meme of the Week

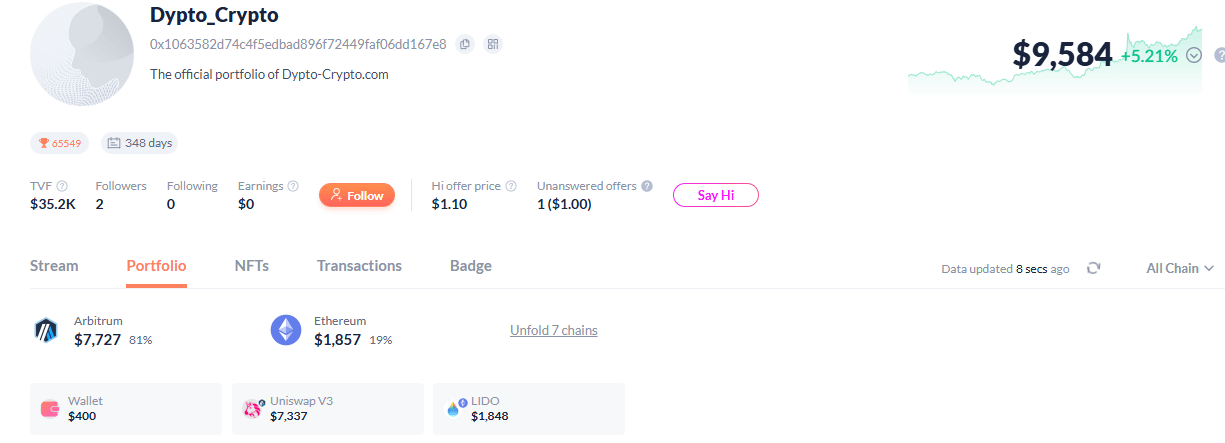

By the Numbers - The Dypto Crypto Portfolio

Here’s a screenshot of our portfolio, which we started in late December 2024.

Original portfolio valuation - 3 ETH (~$9,670)

Current portfolio valuation - $9,584. Growth - Currently at a loss! Oh no!

Here’s why we aren’t worried:

The current level of volatility, which has been substantial, is reflected in printing fees that make us happy. These fees are reinvested, which will grow our position over the long term. Secondly, we’re still making 3% on our Lido position. When ETH price action recovers, our port will be looking better than ever.

Deep Dive - Balancer Got Wrecked in a $100 Million Exploit

Around 7:45 AM UTC on Monday, November 3rd, someone discovered a vulnerability in Balancer V2’s Composable Stable Pools and exploited it. Think of Composable Stable Pools as special containers designed to hold similar assets (like different versions of stablecoins or wrapped tokens) and let people swap between them efficiently.

The problem? A tiny rounding error in how these pools handled certain types of swaps. Sounds boring, right? Except this tiny mathematical hiccup let attackers drain funds from pools across multiple blockchains, including Ethereum, Base, Avalanche, and several others.

Here’s the technical bit made simple: Balancer V2 lets you do “batch swaps,” which bundle multiple transactions together to save on gas fees. These swaps have a cool feature called “deferred settlement” — basically, you can borrow tokens temporarily as long as you pay them back. This term is often referred to as a flash loan.

The exploit leveraged this feature, combined with incorrect rounding when scaling token amounts, enabling attackers to manipulate pool balances and withdraw funds that did not belong to them.

This exploit is yet another example of how code vulnerabilities can remain hidden for years. We’ve seen this multiple times in 2025, unfortunately. These Composable Stable Pools had been live and audited by top security firms. They had active bug bounty programs. And yet, this specific combination of features created a vulnerability that was not discovered for years.

However, there’s a flip side — when the exploit occurred, the decentralized community responded faster and more effectively than most centralized systems could. Validators coordinated network halts. Whitehat hackers mobilized within minutes. Protocols across different chains worked together to freeze assets and limit damage.

Update: As of the time of this writing, there have been no further recoveries reported. The Balancer team has reached out to the hacker and is trying to negotiate a return of the funds.

Question of the Week Answer

We can’t tell you what to do. That would constitute financial advice. But we can say this:

What happened with Balancer is unfortunate. And it’s a nasty side of DeFi that we’ve seen a lot over the years. Has it changed how we feel about it?

No.

Why?

Every time a big protocol, such as Balancer, is exploited, teams of devs and whitehats deploy. They go to work. They implement fixes. They track digital bad guys. And every single time, decentralized finance walks away bruised and beaten up. But also, smarter. Things get fixed. Patched. Users are made whole (most of the time). And the world keeps on turning.

And they do so without government intervention. Without banks. Without any players that we rely on in TradFi when this kind of thing happens to them. The teams are better than ever. They’re faster than ever. We believe it’s only a matter of time before DeFi surpasses many TradFi alternatives in terms of safety and reliability.