For those of you who are new to crypto, you may not know the name Cynthia Lummis. She’s a senator from Wyoming. But more than anything, she was the only friendly face that the crypto industry had in D.C. for a long time. And now, after putting in the work that changed everything, she’s taking a step back.

Gif by PixelBandits on Giphy

But good things happened around the crypto world this week, too. So let’s get after it.

From the Dypto Crypto Newsroom

SoFi Is the First National Bank to Launch Its Own Stablecoin

TLDR

Last month, SoFi added crypto trading back to its list of services.

This week, the company officially launched its own stablecoin called SoFiUSD.

They are the first national bank to do both.

In a landmark move for the intersection of traditional banking and digital assets, SoFi Technologies, Inc. has officially announced the launch of SoFiUSD. The new financial product makes SoFi the first national bank in the United States to issue a stablecoin on a public, permissionless blockchain.

Why SoFi’s stablecoin launch matters for crypto users.

The launch of SoFiUSD is notable not just for the product itself, but for the entity issuing it. While several prominent US dollar stablecoins are currently in circulation, they have primarily been issued by crypto-native firms or fintech companies.

SoFi’s status as a national bank brings a different regulatory framework to the table. By issuing the token through SoFi Bank, N.A., an institution regulated by the Office of the Comptroller of the Currency (OCC), the company is offering a level of regulatory oversight that is relatively new to the public blockchain space.

Washington Is Seeing Crypto-Level Volatility

TLDR

Senator Lummis has announced that she will not seek reelection.

A new bill in the House proposes a tax exemption on small stablecoin payments.

The bill also seeks to allow deferral of staking rewards.

Prices go up fast and down even faster. As crypto users, we know that’s the world we live in. But when volatility hits politics, our eyebrows shoot up, especially when there’s crypto involved.

The halls of Congress are typically known for slow-moving legislation and predictable outcomes, but recent weeks have introduced a level of unpredictability usually reserved for the crypto markets themselves. From surprising retirements to ambitious new tax proposals, Washington’s approach to digital assets is undergoing a shake-up.

Saying goodbye to one of crypto’s best friends in Washington…

This one made us sad in our hearts and hit us right in the feels. Senator Cynthia Lummis (R-WY), often dubbed the “Crypto Queen” of Congress for her staunch advocacy of Bitcoin and digital assets, has announced she will not seek reelection. This move marks the upcoming departure of one of the industry’s most powerful allies on Capitol Hill.

In a candid statement on X, Lummis expressed that despite her devotion to legislation, the physical and mental toll of the job has become unsustainable. “I feel like a sprinter in a marathon,” she wrote, noting that she does not have “six more years” left in her to serve another term.

Lummis has been instrumental in crafting legislation to integrate digital assets into the US financial system. Her departure after her current term raises questions about who will pick up the torch for pro-crypto legislation in the Senate Banking Committee, a crucial battleground for financial regulations.

Question of the Week

From TikTok - “I was looking at the Ethereum validator queue, and the numbers are all over the place. Any idea what’s going on?”

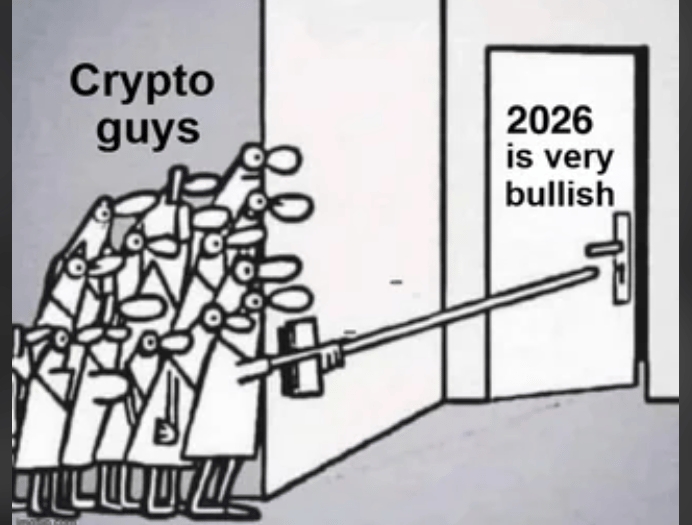

Meme of the Week

By the Numbers - The Dypto Crypto Portfolio

Here’s a screenshot of our portfolio, which we started in late December 2024.

Original portfolio valuation - 3 ETH ($9,670)

Current portfolio valuation - $8,049 YTD - (-)15%

A week has gone by in the crypto world, and there’s only a $2 swing in our port value? Are we even in crypto anymore?

This is what is known as “crabbing”. The market moves up and down, up and down, but when you pull that POV back a bit further, you see it’s really not doing much from week to week. It’s kind of like watching tug of war up close and then stepping back 50 feet only to realize everyone is trying really hard, but nothing is really happening.

In this case, the bulls and the bears have locked horns (we know bears don’t have horns), and are in a good old-fashioned stalemate.

Deep Dive - A New Sheriff’s in Town: Selig Takes Over the CFTC

On December 22, 2025, Michael S. Selig was officially sworn in as the new boss of the Commodity Futures Trading Commission (CFTC), after getting the nod from President Trump.

At the same time, the person temporarily in charge, Caroline D. Pham, announced she’s leaving for a job outside government.

Michael Selig received Senate approval on December 18, 2025, and his appointment brings a wealth of digital asset knowledge to the top job. After his nomination, Selig talked about his plan to create “common sense rules of the road” for today’s markets.

Selig was real about how wild the financial world is right now. He pointed out that people are trading commodities more than ever, and that we have all this new tech that needs updated rules.

Looking at Selig’s resume, it’s obvious he was picked to bridge the gap between old-school finance rules and the new world of crypto. He was the top lawyer for the SEC’s Crypto Task Force and a senior advisor to a former SEC Chairman.

As Selig comes in, Caroline D. Pham is heading out. Pham, who became a Commissioner in 2022 and then Acting Chairman in January 2025, leaves behind a legacy of modernizing the agency and pushing “crypto-forward” policies.

Pham may be out of the CFTC, but don’t cry for her, Argentina. She landed on her feet. Right after announcing her exit, the crypto payments company MoonPay revealed that Caroline Pham would be joining as its top lawyer and administrative officer.

Question of the Week Answer

We can’t say for a fact. But we have a good idea.

After months of more validators wanting out than wanting in, the numbers are starting to flip. And they’re flipping hard.

BitMine Immersion, the single-largest corporate holder of ETH, recently announced it will start staking, with plans to scale those efforts. While a large percentage of that ETH coming in likely belongs to BitMine, there’s also a good chance others are taking this as a green flag that ETH is poised for good things and jumping on the bandwagon.

At least…that’s our best guess…

We’re waiting for official announcements from BitMine to see just how much they laid down for staking.