- The Dypto Times

- Posts

- The Dypto Times - The First Hot Crypto Narrative of 2026? It’s a Goldie but a Goodie...

The Dypto Times - The First Hot Crypto Narrative of 2026? It’s a Goldie but a Goodie...

SoFi and Tether prove that utility > speculation

We’ve said it before. And today, we’ll be saying it again. What’s happening in DeFi today will take over TradFi tomorrow. And right now, there are some interesting developments going on with Lido, ETH’s biggest liquid staking protocol.

Giphy

But that’s not all that happened this week in the cryptoverse. Let’s get after it.

From the Dypto Crypto Newsroom

Lido V3 Launch Is Bringing Sexy Back to Ethereum Staking

TLDR

Lido is the protocol behind the most popular liquid staking product in DeFi.

They’ve just released V3, featuring a new product called stVaults.

The world of crypto moves fast. Sometimes, it moves so fast that you blink and suddenly everything works differently. Today is one of those days. Lido V3 is officially live on the Ethereum mainnet, and it’s bringing some serious changes to how staking works.

If you’re new to crypto, you might know Lido as the protocol that issues stETH. And you’d be right. But with this V3 upgrade, Lido is evolving from a simple staking service into something much bigger: a modular infrastructure.

The problem and the solution.

To understand why Lido V3 is a big deal, we have to look at the headache stakers faced before today. Until now, if you were a big player or a developer, you had a tough choice to make.

You could choose Pooled Liquid Staking (like the classic Lido experience), which gave you liquidity — meaning you could use your tokens in DeFi immediately without locking them up. But you had almost zero customization. You got what everyone else got.

Option two was Bespoke Staking. Bespoke staking gives users full control over how their ETH is staked, who the node operators are, and the rules governing it. The downside? It was usually illiquid. Your funds were stuck in the queue, and you couldn’t easily move them or use them elsewhere.

Introduced as part of the upgrade, stVaults are a new “primitive” (a fancy tech word for a building block). They enable institutions, protocols, and builders to create custom staking configurations while integrating with the stETH network.

These vaults turn Lido from a single product into a shared infrastructure layer. It preserves the composability (the ability for different apps to work together) that makes Ethereum so powerful.

SoFi and Tether Defy Market Gloom with Record Q4s

TLDR

The crypto headlines of late have been nothing short of doom-and-gloom clickbait.

However, two crypto-related companies recently reported impressive Q4 2025 results.

Let’s take a look at Tether and SoFi’s stellar figures and what they say about the real state of the crypto industry.

If you’ve been scrolling through social media or reading the headlines lately, it looks like the crypto industry is in a state of perpetual winter. Sentiment often leans toward skepticism, with market volatility and red candles dominating headlines and conversations. However, a review of the financial reports from major players in the space tells a strikingly different story.

As the Q4 2025 reporting season wraps up, two industry heavyweights — SoFi Technologies and Tether— have released numbers that are nothing short of impressive.

Let’s look under the hood…

From SoFi’s billion-dollar revenue quarter to Tether’s massive profitability backed by US Treasuries, the data suggests that the infrastructure of the crypto economy is stronger than the prevailing mood might suggest.

SoFi Technologies, a company that has aggressively positioned itself as a one-stop shop for digital financial services, reported a historic fourth quarter for 2025. For the first time in the company’s history, quarterly Adjusted Net Revenue surpassed $1 billion, landing at $1.013 billion — a 37% increase year-over-year.

While SoFi represents the convergence of traditional banking and crypto, Tether represents the pure-play crypto infrastructure. As the issuer of USDT (among others), the world’s largest stablecoin, Tether’s Q4 2025 attestation report shows a company operating with profit margins that rival those of the world’s most successful tech giants.

According to their latest report attested by BDO, a top-five global independent accounting firm, Tether delivered net profits exceeding $10 billion in 2025. To put that in perspective, that level of profitability places Tether in the upper echelon of global finance companies, despite having a fraction of the headcount of traditional banks.

Is something off with your cash flow?

If your revenue looks fine, but you're always in reaction mode, you need to take the The Find Your Flow Assessment. It shows you exactly where money friction is occurring in your business and what to fix first. And it only takes five minutes.

Educational only.

Question of the Week

From a YouTube comment: “Why don’t you guys use any leverage with the Dypto Crypto portfolio?”

Meme of the Week

By the Numbers - The Dypto Crypto Portfolio

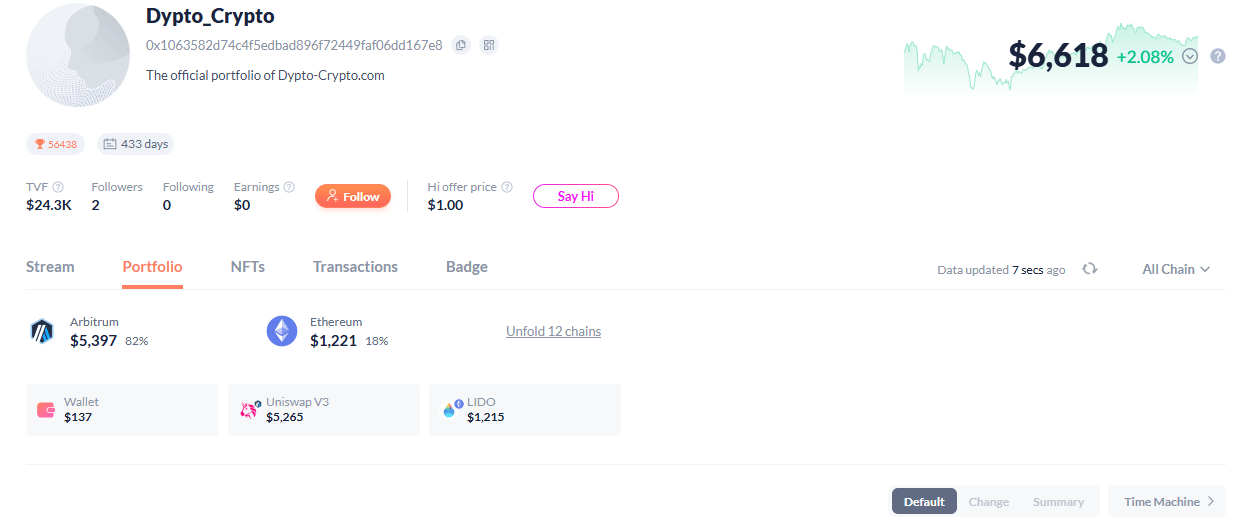

Here’s a screenshot of our portfolio, which we started in late December 2024.

Original portfolio valuation - 3 ETH ($9,670)

2025 portfolio valuation - $8,049 YTD - (-)15%

2026 start - $8,813

Current valuation - $6,618 YTD - (-)%...We don’t want to know…

Oh, boy. Things are getting nasty in the market. This is where we see a lot of people panic-selling. Right about now is where the doomsayers start setting up their soapboxes.

We still have conviction in our plays. We will stay the course. We will not panic, nor will we sell for realized losses. We’re investors. It’s ugly. It’s looking like it’s going to be ugly for a while. That’s ok. Markets go up. And they go down. We will ride it out.

Deep Dive - Gold Is Officially the First Crypto Narrative of 2026

*Turns on epic cinematic voice*

The hottest asset on the blockchain right now isn’t a dog-themed meme coin or the latest Ethereum killer.

It’s gold. But this time…it’s gone digital!

/epic cinematic voice

While the US dollar is taking a nosedive and Bitcoin is struggling to break through its resistance levels, tokenized gold is having a serious moment. Gold is the first crypto narrative for 2026. But will it be the biggest? Is gold the new hope for crypto or just the new hype?

Gold has smashed through records, hitting over $5,300 per ounce at one point. That’s a massive jump, driven by a mix of geopolitical tension and a US dollar that’s seen better days.

When things get scary in the world (wars, sanctions, economic uncertainty), big money still runs to what it knows. That’s always been gold. But now…the digital sheriffs in crypto town (that was a little terrible, wasn’t it?) are buying in and grabbing their shovels and pans.

Who are these…sheriffs? Tether. Who else. The company has quietly become a major player in the gold market while also helping shape this new crypto narrative. They currently hold approximately 130 metric tons of gold.

They’re using it to back their own gold token, Tether Gold (XAUt). Tokenized gold, such as XAUt, is a digital token that represents ownership of physical gold.

Demand for XAUt is exploding. It now accounts for more than half of the entire gold-backed stablecoin market, with a marketcap of $2.35 billion at the time of this writing. People are recognizing that they can own a safe-haven asset without leaving the crypto ecosystem, further pushing the tokenized gold crypto narrative.

Question of the Week Answer

Great question. The main reason is that our entire platform is designed to be beginner-friendly. While we think leverage is a great wealth-building tool, it is not beginner-friendly.

It’s not friendly for anyone, even for advanced traders. We’ve seen people lose small fortunes overnight. Those incredibly convenient leverage bars are just sliders, but that multiplier amplifies both gains and losses.

For example, if we had pushed all the chips in on a short a couple of months ago when ETH started to dip, we would have made a killing. But if we had gone long with leverage, we’d have been liquidated this past weekend, if not sooner. And then there wouldn’t be much of a portfolio to update on.