Uptober is here. The iced white chocolate pumpkin spice witch’s brew lattes are everywhere. The weather is cooling down. And most importantly — the crypto market is pumping.

Giphy

Crypto had another busy week, from Stripe making it easy to create stablecoins to Chainlink helping banks get with the crypto program. Let’s get after it.

From the Dypto Crypto Newsroom

Coinbase Is Having a Moment

TLDR

In the last month, Coinbase’s lending feature has hit $1 billion in loans.

Now, using the same DeFi project, Coinbase users can lend their USDC for decent yields.

Both products utilize DeFi, specifically Morpho, but all transactions occur directly within the Coinbase app.

September has been a whirlwind month for Coinbase. The popular centralized exchange has rolled out some game-changing features that could completely transform how you think about earning money with your digital assets.

Why new Coinbase products matter.

If you’re just getting started in crypto, these developments are significant for several reasons:

Easier Entry Point: You don’t need to become a DeFi expert to access these advanced financial tools. Coinbase handles the complexity while you get the benefits.

More Ways to Make Money: Beyond hodling, you now have additional ways to earn returns on your holdings.

Bridge to Traditional Finance: These features help crypto feel more like traditional banking — you can borrow money, lend money, and earn interest, just like with regular banks, but often with better rates.

Lower Risk Options: USDC lending provides a way to earn yields without the volatility of other cryptocurrencies since USDC is pegged to the US dollar.

Stripe, Visa, Chainlink – Building the Stablecoin Highway

TLDR

Stripe has launched technology that will enable businesses to create their own stablecoin and have it live in a matter of days.

Visa is actively working on using blockchain tech to make international payments cheaper and faster.

Chainlink has developed technology that will enable blockchain to connect directly to the Swift system.

Three major institutions have made some huge announcements that could alter our perspective on digital currency. The highway of the future is digital, and it’s paved with stablecoins.

Stripe launched tools to help businesses create their own stablecoins, Visa is testing stablecoin funding for cross-border payments, and Chainlink figured out how to make traditional banks play nice with blockchain tech.

Why TradFi moves matter for crypto users.

First, we’re likely to see way more stablecoins in the wild. When it’s easy for businesses to launch their own, we’ll probably see industry-specific or region-specific stablecoins that serve particular use cases better than generic ones.

Second, international money transfers could get cheaper and faster. If Visa’s pilot works out, it could put pressure on traditional remittance services to step up their game or risk getting left behind.

Third, the gap between traditional finance and crypto is shrinking fast. When major banks can interact with blockchain tech using their existing systems, it removes a lot of the friction that’s kept institutions on the sidelines.

Aave V4 Is Coming. Here’s What to Expect.

TLDR

Aave V4 is coming, aiming for a Q4 2025 launch

V4 is packed with features, including a new interface.

The team is striving to stay one step ahead and maintain its position as the leading DeFi platform for lending and borrowing, while also incentivizing institutions to utilize its services.

If you’ve been hanging around the DeFi playground, you’ve probably heard about Aave V4. If you’re brand new, you’ve probably at least heard the name in passing. They’re a big deal with a group of devs that are constantly pushing the envelope as far as lending and borrowing innovation.

A major upgrade is on the way, designed to make Aave more flexible, efficient, and user-friendly.

When will V4 actually happen?

The codebase is feature-complete and currently undergoing a rigorous security audit process with multiple firms. Service providers have already started testing, and a public testnet is the next major milestone.

Aave hasn’t provided a firm release date yet, but they aim to publish the full codebase and architecture documentation for community review soon. This will be followed by the public testnet, which will let everyone get a feel for the new system before it goes live on mainnet.

For users, this means better rates, more predictable risk, and a more streamlined experience. For the broader DeFi ecosystem, it unlocks new possibilities for innovation, allowing developers to build on top of Aave in ways that were never possible before.

Question of the Week

From a TikTok comment - “I read that the dollar isn’t super strong right now. Should I start to move away from stables?”

Meme of the Week

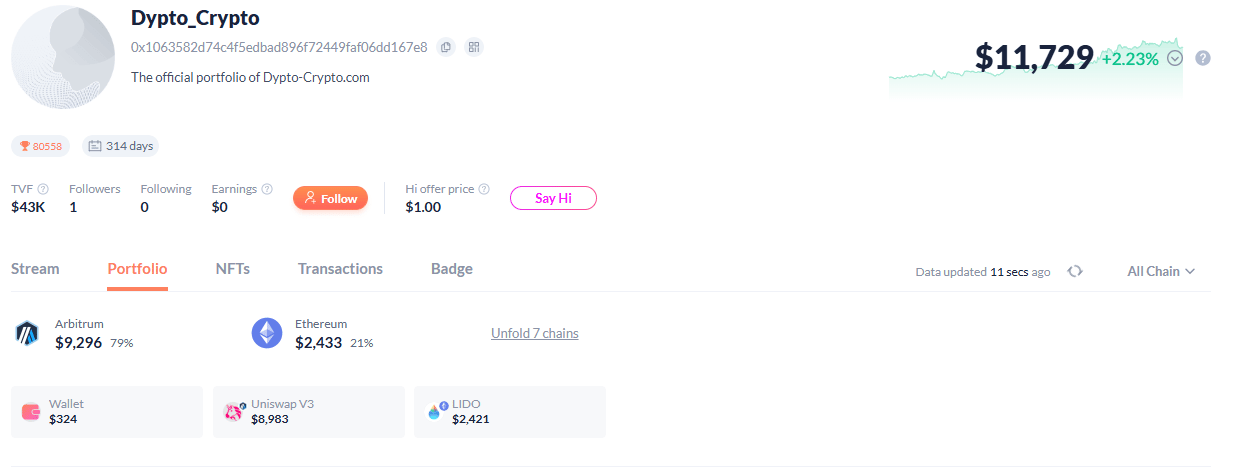

New Segment! - By the Numbers - The Dypto Crypto Portfolio

Here’s a screenshot of our portfolio, which we started in late December 2024.

We’re experiencing a nice Uptober pump to our positions. The positive price action is coming from a few factors, such as the US government shutdown. The dollar has been a bit weak as well. Check out our latest news pieces to read more on those topics.

Original portfolio valuation - 3 ETH (~$9,670)

Current portfolio valuation - $11,729 - Growth 21% on the year.

We know how this looks. Three ETH is currently worth $14,079. What gives?

When users split funds to create a yield farming position, we sacrificed half of that position for the USDC. Now that ETH is pumping, the pool now contains more USDC than it does ETH. This is the pool working as intended. When ETH price drops, the pool will slowly fill back up with that token.

CJ will go into this in more detail in his October analysis, which will be released soon. Join our Circle community to see full updates.

Deep Dive - Uptober Kicks Off as US Government Shuts Down

Welcome to October, also known in the crypto world as “Uptober.” This month historically brings green candles and good vibes to the market. And this year, Uptober is starting with a serious bang, thanks to some drama unfolding in Dub City.

So, what does a government shutdown actually mean? And how does it impact your bags?

On October 1, 2025, at the stroke of midnight, the US federal government officially hit the pause button. No more magical carriage or ball gown.

It resulted from political gridlock over the budget for the 2026 fiscal year. This is the first shutdown since the one back in 2018–2019 and the third under President Donald Trump.

What about your tokens, though?

Bitcoin does what it does best: the unexpected. As news of the shutdown spread, Bitcoin’s price rallied to a two-week high and an eventual ATH.

This might seem weird to newcomers. Why would a government crisis be good for a digital currency? It all comes down to Bitcoin’s reputation as a hedge against traditional economic and political chaos.

Think of it like this: when people lose faith in the stability of government-backed systems and currencies (like the US dollar), they often look for alternative places to park their money. Gold has historically been that safe haven. The times they are a changin’.

Question of the Week Answer

First off, good question. It’s one we’ve never gotten before.

The answer is: it depends. And also, this is NFA.

The versatility of stablecoins doesn’t come from holding them, but from all the things you can do. Want to play around in derivatives markets? You will need a substantial amount of USDT for your position and collateral if you wish to trade with leverage. Yield farming with a liquidity pool that combines one volatile and one stable asset can generate impressive yields, as seen with Dypto Crypto's ETH/USDC position.

Lastly, lending and borrowing are perfect for this kind of scenario. Weak dollar but strong BTC? Loop it and ride the wave, unwind if you start to see macroeconomic shifts that could strengthen the dollar or weaken BTC.

Almost anything you do in crypto with stablecoins, aside from hodling them, will give better yields than any product a TradFi bank offers. And in a down market, staking stables or yield farming can generate better short-term returns than the S&P.

Now that we’ve made a short story long, the TLDR is that USD-backed stablecoins still have plenty of value even with a weakened dollar.