Staking. It’s everywhere we look. It has nothing to do with vampires. There is no Buffy in finance. No Cullen family. Just cold, hard staking rewards.

But that’s not all we have to talk about this week. Let’s get after it.

From the Dypto Crypto Newsroom

New Executive Order: BTC and ETH Coming to a 401(k) Near You

TLDR

President Trump signed a new executive order this week allowing alternative assets to be included in 401(k) plans — including real estate, commodities, and digital assets.

The changes will go into effect next year.

In related news, the Michigan state pension fund has expanded its crypto positions via ETFs.

Thanks to a recent executive order signed by President Trump, Bitcoin and Ethereum could soon be standard options in 401(k) plans across America. This is the biggest news we’ve read about since the GENIUS Act was signed. Granted…that was just a few weeks ago. But still.

What it means for your retirement bags

If you’ve been crypto-curious but haven’t taken the plunge, 401(k) integration could be your perfect entry point. Here’s why:

Dollar-Cost Averaging Made Easy - When you contribute to your 401(k), you’re automatically buying investments regularly over time. Called dollar-cost averaging, it is particularly effective with volatile assets like crypto. Instead of trying to time the market, you’ll be buying Bitcoin and Ethereum consistently, smoothing out the ups and downs.

Professional Management - The executive order emphasizes that plan fiduciaries must “carefully vet and consider all aspects” of these investments. Professionals will be doing the heavy lifting of research and risk assessment, not you.

Tax Advantages - Traditional 401(k) contributions are made with pre-tax dollars, meaning you won’t pay income tax on money you invest in crypto until you withdraw it in retirement. You’re getting tax benefits that don’t exist with regular crypto investing.

Prosecutors Continue Persecution of Crypto Mixer Founders

TLDR

Despite a memo several months ago ending regulation by prosecution, the DOJ has sought, and gotten, convictions of several crypto mixer founders.

Most recently, Roman Storm was found guilty of running an illegal money transmitting service.

Samourai Wallet founders plead guilty last week.

The crypto world just got another reality check. With so much good news, we thought the industry was done, at least for a while, with the one step forward, two steps back approach. For the most part, we have. But news like this hits hard.

While we’d like to think the dark days of going after crypto mixer founders are behind us, recent court decisions show that prosecutors are far from done. In fact, they’re doubling down on their efforts to hold these platform creators accountable.

Why this news is important for crypto users

If you’re just getting into cryptocurrency, these cases might seem like distant legal drama that doesn’t affect you. But they’re actually reshaping the entire crypto landscape in ways that will impact every user.

First, expect much stricter compliance requirements across the board. Crypto exchanges and wallet services are already implementing more robust know-your-customer (KYC) procedures to avoid being seen as enablers of money laundering. This means more identity verification steps when you sign up for accounts, but it also means more legitimacy for the industry overall.

Second, privacy-focused crypto services are getting extra scrutiny. While legitimate privacy tools aren’t going anywhere, companies offering them are being much more careful about how they operate and market their services. The government’s approach also shows they’re getting better at understanding blockchain tech.

Corporate Crypto Treasury News – The “Stakes” Are High

TLDR

Big and public companies are still on their buying sprees.

Three companies are going buck wild on Solana. SharpLink is buying more ETH. All of them are staking on their respective chains.

Strategy continues its push to own all the BTC, with new companies entering the BTC treasury fold.

Corporate crypto treasury companies are still on their buying sprees. The latest moves from institutional players prove that digital assets are what’s on everyone’s minds right now. From Bitcoin mining companies diversifying into Solana to investment firms stacking Ethereum like it’s going out of style, the corporate crypto game is heating up fast.

It’s a big, new, amazing crypto world right now

This week’s corporate crypto treasury moves reflect a maturing crypto market where institutional players are now competing to see who can accumulate the most tokens that they believe will provide the most value to their companies.

The emergence of multi-chain corporate strategies is particularly interesting. While Bitcoin remains the dominant treasury asset, companies are increasingly exploring Ethereum and Solana for their unique benefits. This diversification suggests that corporate crypto adoption will continue expanding across different blockchain networks.

Question of the Week

From a comment on a social media post - “CeFi. DeFi. TradFi. CEX. DEX. What’s the real crypto?”

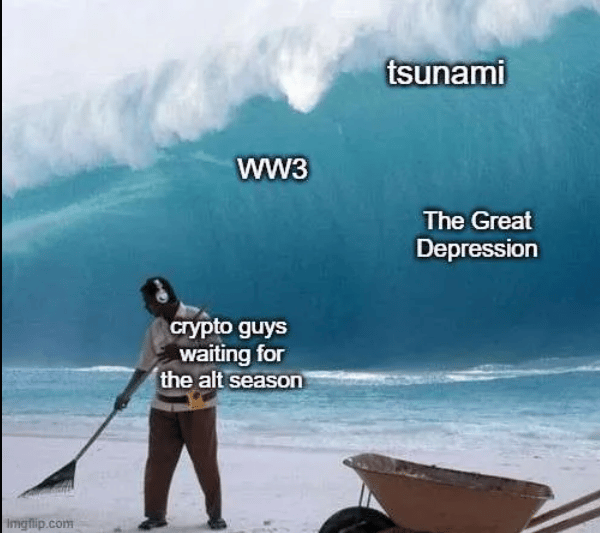

Meme of the Week

Deep Dive - SEC Says Liquid Staking Isn’t Included in Securities Laws

The Securities and Exchange Commission clarified some big news on liquid staking that we’ve been waiting on for months, ever since they announced in May that staking is not a securities transaction. After years of regulatory ups and downs, the SEC finally clarified that liquid staking also doesn’t fall under securities laws.

What is liquid staking?

You deposit your crypto (let’s say ETH) into a liquid staking platform like Lido. Instead of locking up your assets, you get a “liquid staking token” (like stETH) in return. This token represents your original crypto plus any rewards you’re earning from staking.

The magic? You can trade, sell, or use this liquid staking token in other DeFi applications while still earning those sweet staking rewards. It’s like having your cake and eating it too.

ETH is ETH.

Staking ETH earns rewards, and users are usually paid out monthly, but validators hold on to the original deposit for a set time period.

Deposit your ETH in Lido’s protocol. Receive stETH. The rewards are compounded into the receipt token. So that 1 stETH will always be 1 stETH, but it will gain in value over time, at least compared to regular ETH.

The SEC statement signals a more collaborative approach to crypto regulation. Chairman Atkins mentioned the SEC’s “Project Crypto initiative,” suggesting more guidance could be coming for other areas of digital assets.

For new users, this regulatory 180 in 2025 is creating a more stable foundation for learning and investing in crypto. You can focus on understanding the technology and markets without constantly worrying about regulatory curveballs. The crypto space is maturing, and clearer rules benefit everyone, from individual investors to major institutions looking to enter the space.

Question of the Week Answer

It’s all the real crypto. Now that the regulatory environment is shifting, not just in the US but all over the world, more traditional companies are seeing the value in crypto and blockchain tech. It’s important to remember that these things are not mutually exclusive.

Blockchain is its own thing. And it can find a home in most business sectors, unrelated to crypto. In the context of finance, blockchain has the power to make transactions faster and cheaper, which benefits consumers and businesses. The native tokens powering these blockchains are gaining attention as valuable assets to include on a balance sheet in the long term — hence the recent news of numerous companies investing heavily in them.

How retail users choose to invest in crypto or use blockchain is irrelevant. The ETH you buy on Coinbase is no different than the ETH you buy on Uniswap, Kraken, or Robinhood. It’s all crypto. It’s just a matter of personal preference.

Closing Shenanigans

Thanks for reading. Dypto Crypto is a safe place where crypto newbies can learn and ask questions to help them make informed decisions in this exciting and volatile world. We’re having a lot of fun with YouTube shorts and TikTok.

So check out those videos and some of our website's tools. Feel free to ask questions on our social platforms or the site. Thanks for subbing! We’ll see you next week. We hope you guys are enjoying the newsletter, and we’d appreciate some feedback. Feel free to reach out on social media and let us know how we did on the first try.