For months, things were smooth. Regulatory clarity was having an impact. Digital asset treasury companies were hoarding crypto, and token prices were sky rocketing.

Now. It’s back to business as usual in the crypto world.

Good things are still happening all over. But volatility is back, X drama is all over the place, and honestly, we wouldn’t have it any other way. Let’s get after it.

From the Dypto Crypto Newsroom

Bitcoin’s Wild Ride – Uptober’s First Major Speed Bump

TLDR

President Trump announced that massive tariffs would be imposed on China.

The event created extreme volatility in the crypto market.

That volatility led to something called a “liquidation cascade”, further increasing selling pressure on every major token.

By Sunday evening, most coins were already experiencing a decent amount of recovery from the weekend dip buyers.

Man…Uptober was going great, wasn’t it? The crypto world was riding high, everyone was feeling good, and it seemed like the only way was up. Then, last weekend happened. If you glanced at your portfolio and choked on your coffee, you’re not alone. Bitcoin took a nosedive, and the entire market followed suit in a spectacular, gut-wrenching fashion.

What happened? It all boils down to political drama and crypto markets doing what they do best: being volatile.

The beautiful disaster of the market mayhem.

So why did one announcement cause such a dramatic collapse? Let’s look at the underlying mechanics.

The Power of Leverage - Leverage is like a double-edged sword. It allows traders to amplify their potential profits by borrowing funds to make bigger bets. However, it also magnifies their losses. When the price started to drop, it triggered a “liquidation cascade.” As positions were forcibly closed, the sell orders pushed the price down further, which in turn triggered the next batch of liquidations.

Open Interest Takes a Hit - Another key indicator of market sentiment is “open interest,” which represents the total number of outstanding futures contracts that have not been settled. Following the crash, aggregate open interest in BTC showed a sharp decline, signaling that traders were hesitant to open new positions amidst the uncertainty. But more realistically, we think that most traders don’t do much on the weekends, which explains the lack of open interest.

S&P Global Teams Up with Chainlink

TLDR

S&P Global and Chainlink are making stablecoins even more stable. Kind of.

S&P Global will be rating stables on their ability to maintain peg and overall safety.

Chainlink will be responsible for bringing all of that data onchain.

It’s time for the next phase of stablecoin evolution. The keyword here is going to be “stability”. S&P Global Ratings — those folks who rate everything from government bonds to corporate credit — has partnered with Chainlink to bring their stablecoin assessments directly onto the blockchain.

Why this new system is important.

The problem is, not all stablecoins are created equal. And not all of them are capable of maintaining their pegs. Some are backed by actual dollars sitting in bank accounts, while others use complex algorithms or a mix of different assets. S&P’s assessments help users understand which ones are most likely to actually maintain their peg to the dollar.

Their rating system is simple: 1 means very strong, 5 means weak. So if you’re looking at two stablecoins and one has a rating of 2 while another has a rating of 4, you’d probably want to go with the one with the higher rating.

Did X Drama Just Get BNB on Coinbase?

TLDR

A recent tweet from a Coinbase Ventures-backed protocol outlined the requirements for listing on Binance.

Another Coinbase insider commented that an exchange shouldn’t charge to list a token.

This prompted crypto users on X to tell Coinbase to list BNB if that was the case.

BNB is now listed on Coinbase’s roadmap.

Spicy drama on X has pushed Coinbase to finally list BNB, Binance’s token. Coinbase announced it’s adding its rival’s flagship token to its listing roadmap. For those new to the space, this is like McDonald’s suddenly deciding to sell the Whopper. It’s a big deal.

This whole episode is more than just juicy gossip. It shines a light on the competitive, and sometimes petty, world of crypto exchanges. It also raises important questions about how tokens get listed and who really benefits.

What the drama means for users…now and in the future.

Okay, so a bunch of crypto folks had a Twitter fight, and a token got listed. Why should you, a newcomer to crypto, care?

1. Transparency - The process of getting a token listed on a major exchange is opaque and often favors insiders. For the average user, more transparency means a fairer market and less chance of being caught in a project that paid its way to the top.

2. The Power of Community - Never underestimate the power of a riled-up crypto community. The drama is a perfect example of how public pressure can influence decisions.

The crypto community saw an opportunity to call out what they perceived as hypocrisy, and they succeeded in pushing Coinbase to act.

3. Competition Is a Good Thing - At the end of the day, the rivalry between Coinbase and Binance is a good thing for consumers. When giants compete, they are forced to innovate, lower fees, and offer better products to attract and retain users.

Question of the Week

A TikTok DM - “I see a lot of news on the major crypto media outlets reporting about ETF inflows and outflows. What do I do with this information?”

Meme of the Week

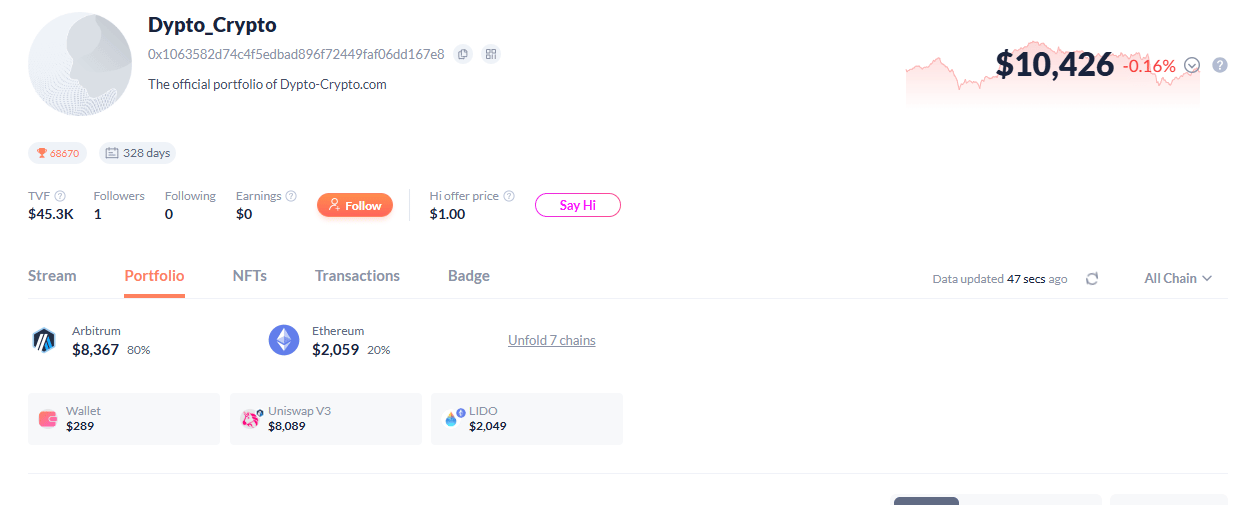

By the Numbers - The Dypto Crypto Portfolio

Here’s a screenshot of our portfolio, which we started in late December 2024.

Original portfolio valuation - 3 ETH (~$9,670)

Current portfolio valuation - $10,426 - Growth 7.8% on the year.

Ethereum is being hit pretty hard with market volatility. Good thing we’re using semi-passive long-term strategies! But seriously, seeing our Debank hurts us even though we’re prepared for this kind of thing. We still think we’re on the right track.

We’re currently being beaten YTD by the SPY, which we would like to outpace by the end of the year. Our fingers are crossed that ETH is just taking a little nap before it drops the hammer like Cole Trickle in Days of Thunder.

Deep Dive - Kraken Buys A Second Derivatives Platform for $100 Million

Kraken just bought another company. While acquisitions happen all the time in the crypto world, this one is a little different. It is, at least potentially, a big deal for the US market. The big squid bought a smallish derivatives platform called Small Exchange.

On the surface, it’s a simple purchase. But the key here is what Small Exchange is: a Designated Contract Market (DCM) licensed by the Commodity Futures Trading Commission (CFTC).

Let’s unpack that:

CFTC: The US government agency that regulates derivatives markets. Think of them as the financial police for things like futures and options. They make sure everything is fair, transparent, and that companies aren’t doing anything shady.

DCM: A Designated Contract Market is basically a fancy license from the CFTC that allows a company to create and list its own derivative products for trading in the US

By buying a company with a DCM license, Kraken has fast-tracked its way to becoming a fully regulated US derivatives player. It’s like wanting to open a restaurant and instead of building one from scratch and waiting years for permits, you just buy an existing one that already has all the licenses.

Question of the Week Answer

The short answer? Whatever you want.

The longer answer? It depends on your goals.

The much longer answer?

takes a deep breath

ETFs are products that aren’t really meant for day trading. You can totally do it, but that’s not really ideal. ETFs are more for buy and hold strategies, which is the TradFi version of hodling. Crypto ETFs don’t cost as much as an individual BTC, ETH, or SOL token. So the prices are a bit easier to digest.

The reports on inflows and outflows are less about price action and more about market sentiment. If the markets running red hot and seeing a ton of inflows, you can use that information to do things like selling a covered call or looking to take some profits before a dip, especially if you’re watching flows meticulously. Conversely, you can use heavy outflows as an opportunity to enter at a more reasonable price.

Lastly, having a broad view of the market, even if you don’t participate in TradFi isn’t a bad idea. Crypto is a growing ecosystem, but it still doesn’t have anywhere close to the volume of the US stock market, which doesn’t have anywhere close to the volume of the global Forex market. So in perspective, it’s still relatively small. Watching from multiple angles may give you a glimpse into the price action crystal ball so you can plan short term moves accordingly.

Circling back around, we love ETFs. But we use them for hodling to hedge again regular trading activities.