We knew stablecoins would be the first crypto product to go mainstream. But the second? That was anyone’s guess. If you had told us it would be prediction markets, this would have been our response:

Giphy

But here we are. And that’s not all that went down this week. Time to get after it.

From the Dypto Crypto Newsroom

Chainlink Gets a Wall Street Glow Up

TLDR

Grayscale has launched a Chainlink ETF with the ticker symbol GLNK.

Chainlink is the oracle protocol that makes up the backbone of decentralized finance.

This is the first time Chainlink has seen the love it deserves from TradFi, despite working with dozens of TradFi companies worldwide.

Chainlink (LINK), the crypto world’s go-to for connecting blockchains to real-world data, is finally getting some love on the stock market. After years of being a darling in the decentralized finance (DeFi) space, it’s now making moves in traditional finance with the launch of a new investment product.

Grayscale Investments, a big name in the digital asset world, rolled out its Grayscale Chainlink Trust ETF (ticker: GLNK) on the NYSE Arca exchange. Regular (retail) investors can now get a piece of the Chainlink action through a familiar investment wrapper — an Exchange-Traded Product (ETP) — without having to navigate the often-tricky world of crypto exchanges and digital wallets.

Why users should care about Chainlink.

Chainlink is what’s known as a “decentralized oracle network”. Blockchains are great at a lot of things, but they’re terrible at talking to the outside world (and each other). They’re like isolated computer networks that can’t access real-world information on their own.

Oracles act as a secure bridge, feeding real-world data to smart contracts on the blockchain. Chainlink is the most popular and widely used oracle network out there. It’s a decentralized network, meaning it’s not controlled by a single company, which makes the data it provides more secure and tamper-proof.

Chainlink’s tech underpins a huge part of the crypto ecosystem, securing tens of billions of dollars across DeFi, NFTs, gaming, and insurance applications. It’s the invisible plumbing that makes much of Web3 work.

DAT Drama: FUD or Legitimate Concern?

TLDR

Media outlets rely on drama and clickbait titles to get reads.

Right now, large DAT acquisitions are not part of the narrative.

However, the drama surrounding the market, and notably, digital asset treasury companies, is overblown. Here’s what’s really happening.

Headlines are screaming about liquidation risks, market meltdowns, and corporate whales dumping their bags. It’s enough to make even the most diamond-handed investor a little sweaty. But is all this drama legit, or is it just another classic case of FUD (Fear, Uncertainty, and Doubt) in a down market?

Everyone’s looking for a villain when prices are in the red, and big-money players like DATs are an easy target. The narrative that these giants are about to fold and crash the market seems a bit overblown. In reality, many of these companies are sticking to their long-term conviction.

The biggest DATs are sticking to the game plan.

Strategy has been proactive in addressing investor fears. They recently launched a “BTC Credit” dashboard to provide more transparency about their financial health. According to their data, they have enough assets to cover their debt obligations for decades, even if Bitcoin’s price stays flat.

On the Ethereum side of the fence, BitMine recently announced that its crypto and cash holdings have reached a staggering $11.2 billion, including 3.63 million ETH tokens. That’s a whopping 3% of the entire Ethereum supply. Their stated goal is to acquire 5% of the network.

In just one week, the company acquired nearly 70,000 ETH. Shortly after, reports surfaced of another purchase of over 14,600 ETH worth around $44 million. This is not the behavior of a company that’s scared or on the verge of liquidation.

Kalshi Prediction Markets: CNN’s New Partner

TLDR

Kalshi is a fully regulated prediction market.

Prediction markets were born in crypto just a couple of years ago.

CNN has partnered with Kalshi to integrate prediction market data into the news giant’s programming — officially making prediction markets mainstream.

Kalshi and Polymarket are two of the biggest names in prediction markets. The difference? Polymarket is a DeFi blockchain-based entity on the Polygon network. Kalshi is a fully regulated market that has no ties to crypto or blockchain. But… prediction markets are the hottest narrative in finance right now, and they were born in Crypto Land.

CNN has announced a partnership with Kalshi, the world’s largest federally regulated prediction market. It’s a perfect example of how something that was crypto-centric became mainstream in just a couple of years. So, keep in mind that what is crypto-only today could be getting used by everyone tomorrow.

Why this story is such a big deal.

We are seeing a convergence of traditional media and new financial tech. It started with Bitcoin ETFs making it to Wall Street, and now we have prediction markets making it to CNN.

For those of you just dipping your toes into digital assets and new financial technologies, this is a massive green flag. It shows that the tools being built in this ecosystem are powerful enough to complement — and maybe even outperform — the legacy systems we’ve relied on for decades. The proof is in the pudding, as they say.

Question of the Week

From TikTok - “Do you guys think SBF will receive a pardon?”

Meme of the Week

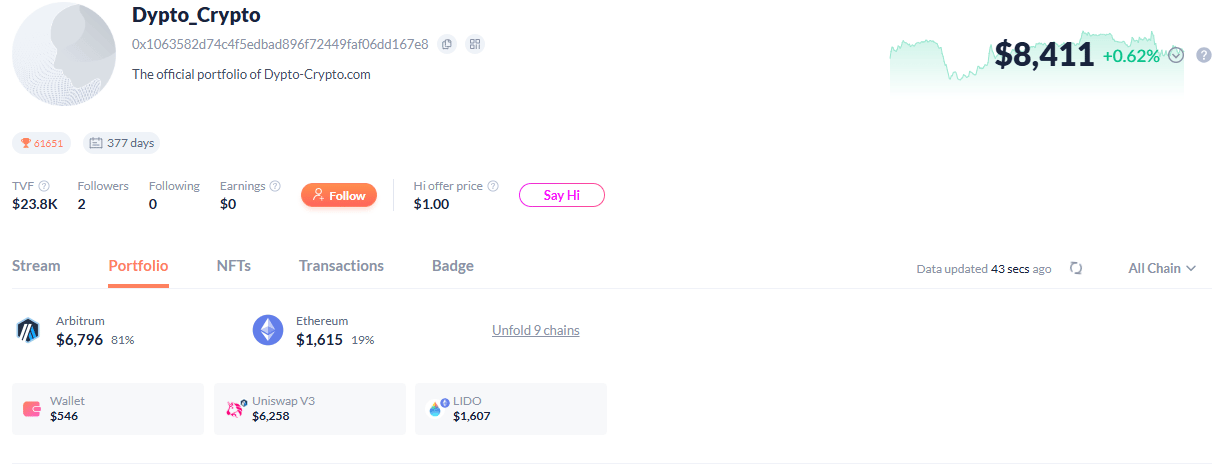

By the Numbers - The Dypto Crypto Portfolio

Here’s a screenshot of our portfolio, which we started in late December 2024.

Original portfolio valuation - 3 ETH ($9,670)

Current portfolio valuation - $8,411 YTD gain - (-)13%

ETH had a strong weekend. It’s showing some resilience. And this is probably due, at least in part, to the current supply shortage. We just wrote an article about this. Check it out.

Right now, we’re channeling our inner Tay Tay and asking, “Are we outta the woods yet?”

While we can’t answer that with 100% certainty, we’re still very happy with our current position.

Deep Dive - Hostile Takeover? YZi Labs Wants Control of BNB Treasury

We’ve seen a lot of things in our years in the crypto industry. We’ve seen APYs in the millions. We’ve seen Tomb forks. We lived through crypto winter. But a crypto company initiating a hostile takeover of a TradFi company? Well…I guess we can add that to the crypto bingo card now.

YZi Labs — an entity linked to Binance founder Changpeng Zhao (CZ) — made a bold move to seize control of the board of CEA Industries (ticker: BNC). If you’re scratching your head wondering, “Who is CEA and why does CZ care?” you aren’t alone. The story involves a vape company, a massive pivot to crypto, and a stock price that fell off a cliff.

In a regulatory filing submitted on Monday, YZi Labs announced it plans to shake up CEA Industries’ board of directors. They aren’t asking nicely, either. They are asking shareholders to support a move that would essentially wipe the slate clean and install their own hand-picked team of directors.

Until recently, CEA was a Canadian vape company. But in July, the company decided to pull a massive pivot. They announced plans to become a “BNB treasury company”. A treasury company in this context is a business that holds a massive amount of a specific asset (in this case, BNB, the native token of the BNB Chain) on its balance sheet.

The market went wild for this idea. When the news dropped on July 28, the stock surged a mind-blowing 550%, hitting a peak of $57.59. It seemed like a genius move.

But the honeymoon phase ended quickly. Since that July peak, things have gone south. Fast.

Shares in CEA Industries (BNC) have tumbled around 89% from that $57.59 high. By the time CZ and Co. launched their takeover bid on Monday, the stock was trading at a measly $6.47.

YZi Labs, which helped bankroll CEA’s pivot with a massive $500 million investment, is clearly tired of watching the red candles. In their filing, they didn’t pull any punches regarding why they think the ship is sinking.

Question of the Week Answer

We don’t know. And we’re happy this question wasn’t “does he deserve one”, because we would not want to answer that, nor would we want the eyebrow twitch that would come with it.

While Silk Road’s Ross Ulbricht and Binance’s CZ have both received pardons, the “crimes” were much different. It’s definitely possible that SBF could get one. But what he did is still pretty fresh in a lot of people’s minds.

Crypto users, especially those who lost everything, have a long memory. And honestly, if he were to be pardoned any time soon, we would be concerned for his safety.